We're going to talk about the most recent in the long line of celebrities who have died and left behind a total mess when it comes to sorting out their estate. When we see these stories hit the news we always wonder how can celebrities still do this? I mean, there have been so many stories recently, when I went back and looked at some of my files we have:

- Naomi Judd cutting her daughters out of her will

- Tupac's estate fighting over an NFT

- Tom Petty's children fighting with their stepmother over control of his catalog of music

- George Jones where they found they discovered Lost Tapes from his family have to figure out whose controls and moves them

- Here in Minneapolis, we've had Prince's estate, trying to figure out first of all what it's worth so the IRS can get paid and then after that also, who's going to be in control who's inheriting his assets

- Larry King used a handwritten will to divide his estate

- Tony Hsieh, the former founder of Zappos, died with a wall full of post-it notes supposedly detailing charitable donations.

On the other end of the spectrum, folks like the Queen of England, Ric Ocasek, and Kirk Douglas, who all had very clear estate plans in place so that none of these kinds of things are going to hit the news.

Anne Heche Died Without a Will

So what we're finding out now is that she died without a will. She leaves behind two sons, a 20-year-old and a 13-year-old. Her 20-year-old son Homer is asking to be the administrator of her estate. The father of her 13-year-old (named Atlas) is contesting that he wants to be the administrator of the estate, not Homer. So what the court is currently trying to figure out is who is going to be the administrator of Anne's estate. Supposedly, there's a 2011 email from Anne to Atlas' father James, asking him to oversee her estate if anything happens to her, so her assets would go to him and he would then divide it amongst the two sons, with each son getting their inheritance at the age of 25. However, James claims that Homer should not be the administrator at this date because he's still immature and not ready.

The Administrator of Her Estate

The administrator of the estate is important because when you have someone like Anne who's been in movies and has upcoming projects, she also had a book that's about to come out. We need to make sure we have an administrator who can take care of all these upcoming projects that need to be released and be the person who administers and deal with copyrights and be able to profits that come from but by not having a will, or having the will solely be a 2011 email that was supposedly sent to the father of one of our children and is left to the court to figure out.

What Should Anne Have Done?

If Anne had an attorney, what should she have done instead?

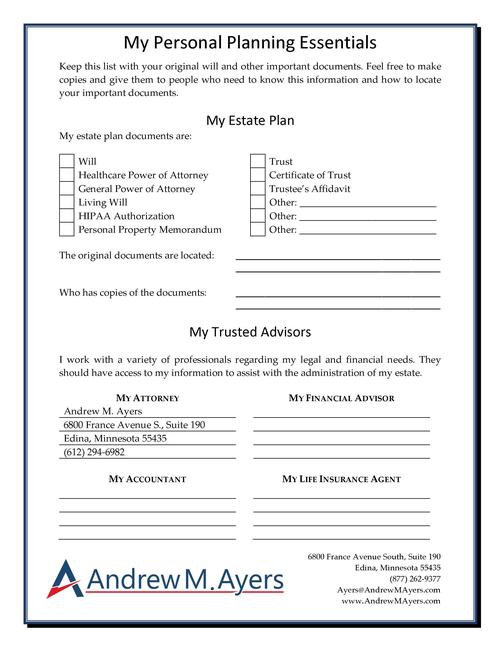

- Well, first of all, we need a guardianship provision for Atlas, he is only 13 years old, so we want to make sure we have a guardianship provision in a will. We want to have a will that says as long as my children are under the age of 18, here are the people I would want to be the guardians of my child.

- Along with the guardianship, we would also want a trustee appointed for that child who's under 18. Homer doesn't need one of these because he is over 18, he is 20 years old, but for Atlas, we want to make sure we have a guardianship provision and a trustee to manage funds with them, especially in the case where the estate can be significant. You don't want to give millions of dollars to a 20-year-old, especially not to a 13-year-old.

- We'd have somebody appointed as administrator. Right now, we have a dispute between a 20-year-old son and the father of another child. And what the court now has to go through is figuring out which one of these two is appropriate is the right person to be the administrator of the estate. The smarter way to do it is to create an estate plan and create a will that would appoint somebody as administrator. In the case of someone like Anne, she may have even chosen a business manager someone else she works with, was familiar with her business dealings familiar with her projects would be the best suited to be the administrator of the estate.

- Create a trust. If Anne was really concerned about her children inheriting money from her and holding that until the age of 25, what may have made sense would be to create a trust-based estate plan where all the funds in her estate go to the trust, and the trustee can manage it for Atlas and can manage it for Homer. So let's say Atlas is going to go to college in about five or six years. The trustee can manage the money in the estate to make sure that college expenses are paid for and then at the age of 25, whatever's left in the trust can be distributed to Atlas, in the case of Homer at the age of 20, the same thing applies. Maybe he's going to school maybe as other needs, and then the trustee can manage the money for him. And then when he hits the age of 25, it can be distributed to him.

Hopefully, you can see that celebrities have the same problems the rest of us have when it comes to estate planning, a lot of them never get around to it, and then you're left with the stories. Now the difference is what happens to you chances are it's not going to make international nervous that's not going to be the front page of a website, that you John Smith died without a will. However, the issues are still the same. Even if they're not all over the news.

Next Steps

So rather than try to do it yourself, don't just send an email from about 11 years ago claiming to be or will and what you want to have happen. Create an estate plan. You want to work with professionals, work with an attorney, work with your financial advisor, work with an accountant to put together a plan especially when you have children under the age of 18 like and you want to make sure that you have a plan set out for them so they're not left adrift without any guidance of where to go. If you're ready to get started, we can set up a Legal Strategy Session, a 15 or 20-minute phone call to go over where you are in the process. Whether we're updating an old estate plan, or starting fresh, or creating a new one. We want to make sure that you know your options and have the best way to plan for your legacy.