Planning for a child with special needs is an extremely important part of your estate plan. Hopefully, your child will live a long and enjoyable life and you will be there to help guide them through the many administrative hurdles they may face while navigating our society’s benefits system. But when you are gone, you need a comprehensive plan in place to provide for your child and protect their benefits. A special needs trust is often the best estate planning option for you and your family.

Planning for a child with special needs is an extremely important part of your estate plan. Hopefully, your child will live a long and enjoyable life and you will be there to help guide them through the many administrative hurdles they may face while navigating our society’s benefits system. But when you are gone, you need a comprehensive plan in place to provide for your child and protect their benefits. A special needs trust is often the best estate planning option for you and your family.

There are some common questions that you can ask yourself before you get started creating a special needs-based estate plan:

- Does your child need a Special Needs Trust?

- Can your child manage funds without assistance?

- Does your child need to continue to receive their government benefits?

If your answers are "Yes-No-Yes" to these questions, then you’ll want to make sure you have the right estate plan to protect your child.

Why Do You Need a Special Estate Plan?

As you probably know, the government benefits system can often be changed mid-stream, leaving you with no choice but to alter your financial plans and find new ways to care for your children. While your child is often eligible for some kind of financial assistance and benefits from the government, without proper planning, assets they inherit from you could disqualify them from receiving their benefits after you’re gone.

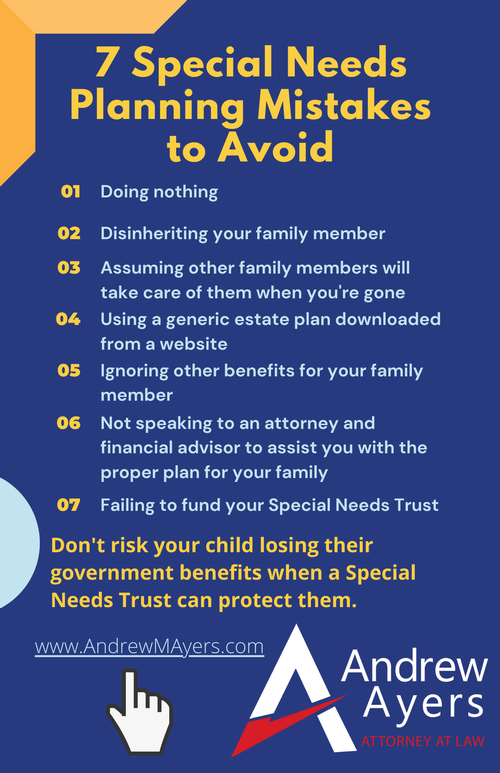

If you use a traditional estate plan and just give assets to a child with special needs, you risk them losing their government benefits. Some parents have tried to DIY the situation themselves by either,

- Disinheriting the child with special needs

- Leaving assets to another child who can provide for their sibling with special needs

Both of these “solutions” come with significant risk and are not the best way to approach your legacy for your child. Disinheriting a child is a callous legacy to leave, especially because that child is often the one who could most benefit from your legacy. And choosing to give an inheritance to a sibling doesn’t guarantee that it will actually be used to help your child with special needs. What if they fall on hard times financially and they need the inheritance to keep their own household afloat? Or what if they die and under their will, the money passes to their children who have no obligation to provide for their aunt or uncle with special needs.

Your special needs trust also must be clear on what kind of distributions can be given to your child. Generally, distributions to your child can only be for things that are not related to food or shelter (items commonly provided for in their government benefits). Trying to use a shortcut won’t guarantee that your child won’t lose their benefits.

Don’t try one of these shortcuts – make sure you’ve got the correct estate plan to protect your legacy and ensure that your child with special needs is properly provided for and their government benefits protected.

What is a Special Needs Trust?

A special needs trust (commonly referred to as an SNT) is the primary document in your estate plan that is used to protect the government benefits your child receives when they inherit assets. It is specifically designed to address those benefits and make sure that your child can continue to receive them by providing financial assistance that supplements, but doesn’t replace, the government benefits.

There are three types of special needs trusts:

- First-party special needs trusts: This is funded using your child’s own assets and upon the death of your child, the government is able to take whatever’s left under a concept known as estate recovery.

- Third-party special needs trusts: This is funded by someone other than the special needs child and there is no governmental reimbursement or estate recovery when your child dies.

- Pooled Trusts: This type of trust holds funds from many different people with special needs. It is often set up by a charity to allow multiple people to put their resources together and when they die, a portion goes to the government and a portion goes to the charity.

Practically, I see third-party trusts far more often than first-party ones or pooled trusts. They can be used to protect your child’s inheritance and benefits and can then be distributed to other family members or loved ones in case your child dies.

Choosing the correct type of trust for you and your family is an important decision. If you’d like to discuss your options further, let’s set up a complimentary Legal Strategy Session to review what makes the most sense for you and your family.

Who Should be the Trustee?

If you are setting up a trust, the "trustee" is the person who will administer the inheritance for your child. Choosing who should be the trustee is probably the most important decision you’ll make when setting up an SNT. Some common options for a trustee include:

- Other Family Members

- Friends

- Corporate Trustees

- Professional Fiduciaries

Regardless of what type of trustee you choose, your first consideration should be whether they are trustworthy and responsible. They will be in charge of the financial future for your child and you want to make sure they understand that and can act accordingly. Unlike other types of trusts, your child as the beneficiary isn’t in a position to keep an eye on the acts of the trustee. Most distributions will be the sole discretion of the trustee and so you need to have confidence that they will make them in the best interests of your child.

Some characteristics of a good trustee:

- Can use discretion in the best interests of your child

- Understands public benefits

- Wise with investments (or can work well with your financial advisor)

- Understands taxes

- Can keep good books and records

- Can advocate for your child

Even though you select a trustee, your work is not done. You also want to choose backup trustees, called “successor trustees,” who can be the trustee if the original trustee is unwilling or unable to serve as the trustee.

If you are concerned about having only one person acting as a trustee, you can choose "co-trustees." In this type of set up, each trustee is there as a check on the other. This way, you have a second opinion and set of eyes on any proposed distributions.

Corporate and professional fiduciaries can be used if you don’t have anyone you really “trust” to serve as trustee. But you should remember that it is common that a corporate trustee will charge a fee for their services and you’ll want to know ahead of time what kinds of fees they charge. Also, to add a “personal” element, many people will add a loved one or family member to assist the corporate trustee with making decisions for your child. The corporate trustee often doesn’t know your child or what is best for them, and this allows you the benefits of a trusted advisor with the personal knowledge of someone close to your child.

Choosing a trustee is a crucial decision for the long-term care and support of your child. Don’t forget to lay out a complete trustee structure, including successor trustees, so that you have a system in place for your child’s legacy.

How Much Do I Need to Set Aside for My Child?

One of the most common questions when creating an estate plan is, How much do I leave to my children? Especially in the case of a child with special needs, calculating the cost of care and what they will need can be next to impossible.

I’ve encountered two main types of plans from my clients:

- Minimalist – only the bare minimum of what your child needs

- Safety Net – provide as much as possible as a safety net

As you start your planning, the first stop will be looking at what kind of benefits your child currently receives and what benefits do you expect them to continue to receive. Your SNT should not be distributing money for things like food and shelter as that can endanger the ability to continue to receive benefits. Beyond those benefits, what other needs does your child rely upon on a daily, weekly, monthly, and yearly basis?

A good vehicle for funding an SNT is an insurance policy. This will often allow you to provide a significant monetary benefit at a fraction of the cost of investment. Working with a qualified insurance professional can help you find the best possible policy for you to help achieve your goals. Especially if you are planning for a safety net, you’ll want to maximize the amount of your legacy for your child, and an insurance policy is often a great way to do that.

No matter what plan you end up adopting, you should be sure to also consult your accountant or other tax professional to be sure you are optimizing the tax benefits for you and your child.

Whether you are looking for a safety net or a minimalist structure, make sure to consult with professionals to ensure your child is protected to the extent you are seeking.

Working With A Care Manager

A Care Manager can be one of the most important people in your special needs planning. They are professionals who can assist your child and advocate for them when needed. It is common that they know your child very well and can be a key source of information for trustees determining what kinds of distributions to provide for your child. If they work in a clinical setting, they can even help improve your child’s mental and physical health through their interactions.

When using a Care Manager in your estate plan, they commonly:

- Assess your child’s needs

- Develop plans for distribution (that are occasionally updated)

- Help direct the trust distributions to comply with benefits

- Allow the trustee to make informed decisions

They are also commonly referred to as an Advocate for a Child because, at the end of the day, that’s one of their primary roles. And you don’t need to wait until you’re on your death bed to have the Care Manager assist you. There may come a time when you can no longer assist your child on a day-to-day basis. They need an advocate and you can work with a Care Manager to ensure they have the right one on their side.

If you’re creating a special needs-based estate plan, be sure to consider using a Care Manager for your child. When you are gone, they can really benefit from an advocate on their side.

Why You Should Work With Professionals

The process of creating a special needs trust is likely more emotional than you think it will be. It can be very hard to think of the various scenarios that can happen to your child when you are gone. If your child has been living with you their entire life, you’ll need to have a plan for where they would live after you are gone. Will that be a long-term care facility? Are they able to live on their own?

At the end of the day, the most important part of special needs planning is that the plan is tailored to your family, to your child’s situation. Downloading some forms from a website and hoping they work is like trying to shoot a bow and arrow blindfolded. Your assets will go somewhere, but it may end up being the government because the trust was incorrectly drafted.

The way to protect your legacy is to work with professionals who understand the issues you and your family face. Speak to your financial advisor about making sure your assets are correctly invested and able to provide support to your child. Check with your accountant to make sure you’re taking all the correct deductions and your child’s benefits are being properly treated for tax purposes. If your child has a social worker, reach out to them to see what recommendations they have as far as the day-to-day needs of your child. And work with an attorney to create special needs planning tailored to your child’s future.

Special needs planning may seem like an intimidating concept, which is why some people try to use a shortcut to get around it. Don’t be tempted to gamble with your child’s future using a shortcut – create an estate plan that protects your legacy and provides for your child and protects their benefits.