When you are raising a child with special needs, it's especially important to have your planning in place for their care. Beyond a simple estate plan that many families create, parents of children with special needs need to make sure that they work with financial advisors and other professionals as well when creating their plan for their children. Last week, the New York Times had a good article discussing the challenges that families go through when planning for a child's care after they're gone.

When you are raising a child with special needs, it's especially important to have your planning in place for their care. Beyond a simple estate plan that many families create, parents of children with special needs need to make sure that they work with financial advisors and other professionals as well when creating their plan for their children. Last week, the New York Times had a good article discussing the challenges that families go through when planning for a child's care after they're gone.

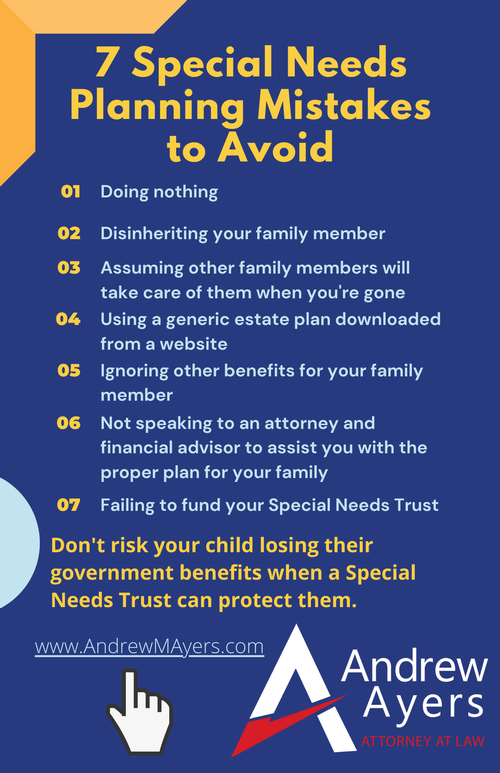

As all other families should, families who have members who have special needs should be reviewing their planning at least yearly to make sure they've got their family members protected. While it's important to have your estate plan in place, the New York Times also points out the importance of working with a financial advisor to ensure that your assets are being held in the proper financial institution. Just holding your money in a savings account or a checking account isn't going to protect your legacy if something happens to you and your family member with special needs is left without support.

The financial tactics that some families use include special needs trusts and life insurance policies to fund those trusts to protect family members with special needs. As the article points out, the government benefits system can be a nightmare for families to navigate, which is why many turn to financial advisors and special needs trusts to ensure that their family members are protected.

What is a Special Needs Trust?

A special needs trust is a specific type of trust that is designed to manage the assets for a person with special needs so that they continue to receive their governmental benefits. If you've never created a trust before (or you've managed to avoid the many books and podcasts that recommend a trust to all of their listeners and readers), it is commonly used in estate planning to provide a way to manage your assets for others after you've died. If you're involved with a trust, it's usually in one of three ways:

- Grantor - the person supplying the funds for the trust;

- Trustee - the person or institution managing the funds;

- Beneficiary - the person who is benefitting from the funds in the trust.

The trust is created by a document, sometimes a very long and complex document, that says what the grantor wants to do with the funds, how the trustee is to manage and distribute the funds to the beneficiary and how or when the trust is to end.

Types of Special Needs Trusts

There are three common types of special needs trusts. When you are considering creating one, there can be advantages and disadvantages to each one, and it's important that you do some research and work with professionals to create the right type for you and your family.

- First-Party Special Needs Trust ~ this type of trust holds assets that belong to the person with special needs (things like an inheritance or proceeds from a lawsuit settlement) and upon the death of the person with special needs, the government is entitled to take whatever's leftover under a concept known as estate recovery.

- Third-Party Special Needs Trust ~ this type of trust has funds that belong to other people and are being used to help the person with special needs.

- Pooled Trusts ~ this type of trust holds funds from many different people with special needs. It is often set up by a charity to allow multiple people to put their resources together and when they die, a portion goes to the government and a portion goes to the charity.

While there are three options, it is most common that the clients I work with prepare third-party special needs trusts. As you can probably guess, the most important consideration for many of them is that they do not want the remaining assets to be recovered by the government when the trust terminates. By using a third-party special needs trust, you are able to fund it with almost any type of asset, including real estate, investments, insurance and other assets. And when the person with special needs dies, the remaining assets can then be transferred to other family members (or other beneficiaries) without having to repay the government.

Can I Establish a Special Needs Trust?

Anyone can create a special needs trust - the person with special needs does not need to be your child or a direct relative. They are a great way to help provide for someone who can use some extra support and is not able to manage their affairs on their own. Especially if they are receiving government benefits, the trust is a way to leave a lasting legacy for their care and support.

Next Steps

If you have a child with special needs, you likely understand the complexity of dealing with government benefits and wouldn't want to leave that burden to your child without a proper plan in place. To get started, let's set up a complimentary Legal Strategy Session to discuss the best options for you and your family.