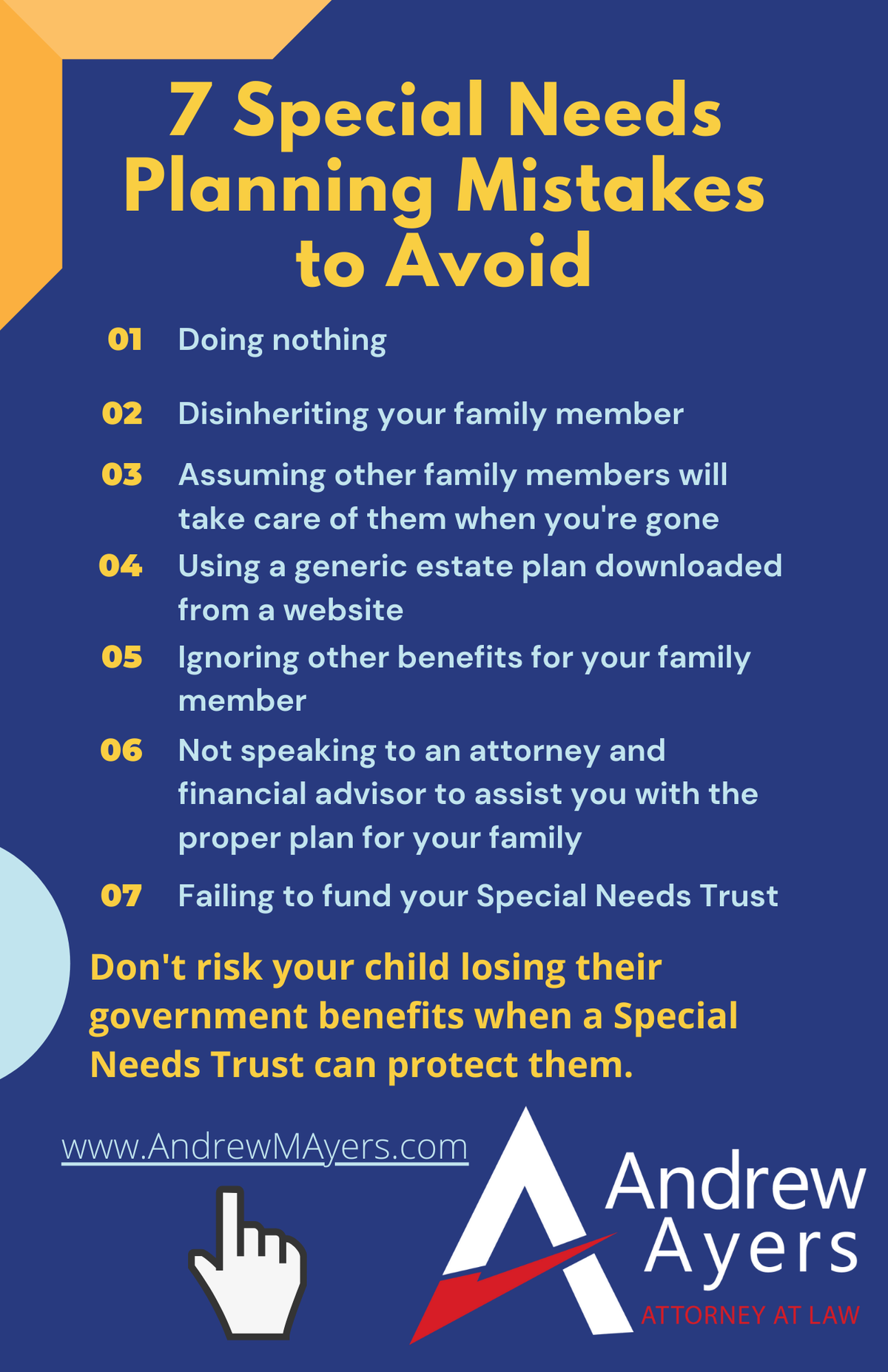

If you are putting together an estate plan that includes a family member with special needs who receives government benefits, here's a quick checklist to help you avoid some common mistakes that many people run into. This is not one of those areas of law where you should try to save a few dollars and just download an online form and hope that it works after you're gone. Your family members deserve better and it's important that you consider the best way to provide for them after you're gone. The mistakes you need to avoid are:

- Doing Nothing

- Disinheriting Your Family Member

- Assuming Other Family Members Will Take Care of Them When You're Gone

- Using a Generic Estate Plan Downloaded From a Website

- Ignoring Other Benefits For Your Family Member

- Not Speaking to an Attorney and Financial Advisor to Assist You With the Proper Plan for Your Family

- Failing to Fund Your Special Needs Trust

- (A Bonus Mistake that You'll Find Out When You Download the Free Report)

If you'd like more information about these mistakes (and the Bonus Mistake that wasn't included in the checklist) and a short primer on Special Needs Trusts and some of the other issues you need to consider, simply fill out the form below and you'll receive an email with information on a free report with a more in-depth look at these mistakes.