As a Business Owner, you want to focus on running your business, not getting bogged down in various legal issues that steal time away from the work you love. Even though websites will tell you that it’s easy to DIY a contract or use an app on your phone to mediate a dispute, doing so can put your business at risk. Taking the time to ensure your business has a solid legal foundation is vital to your long-term success.

As a Business Owner, you want to focus on running your business, not getting bogged down in various legal issues that steal time away from the work you love. Even though websites will tell you that it’s easy to DIY a contract or use an app on your phone to mediate a dispute, doing so can put your business at risk. Taking the time to ensure your business has a solid legal foundation is vital to your long-term success.

Most Business Owners are here for one of the following legal areas of need:

- Starting a Business

- Expanding a Business

- Negotiating Contracts

- Collecting Client Balances

- Business Litigation

- Business Succession

- Corporate Dissolutions

- Other Business Law Needs That Aren’t Easily Categorized

I work with clients in a wide range of industries—from family-owned and operated restaurants to thriving manufacturing facilities with ambitious expansion plans. No matter what concerns you’re dealing with, I’ll explain your options in plain English and help you find the best way to achieve your goals.

Starting a Business

Business Owners start their businesses because they are passionate about their work and want to create a company that reflects that passion. Unless you are a lawyer, chances are all of the paperwork and legal filings that go along with starting a business aren’t things that you are passionate about. As you get your business started, you have a seemingly endless list of items to be done. Rather than getting bogged down in the minutiae of what it takes to legally form your business, it’s a better use of your time to have an attorney take care of the legal requirements to launch your business.

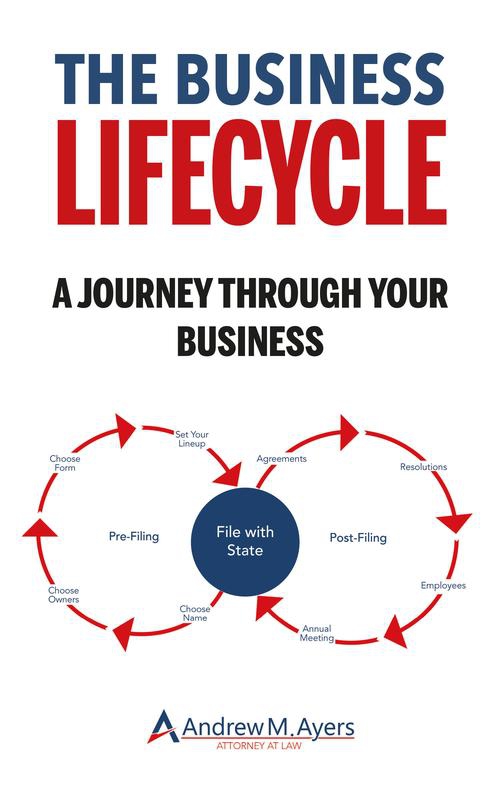

There are some common steps that a Business Owner encounters when you form a new business:

- Filing Articles of Incorporation with your state

- Drafting Initial Bylaws or other corporate agreements

- Obtaining a Tax ID number

- Opening a Bank Account

- Negotiating a lease for an office or storefront

- Filing trademark applications with the USPTO and your state

I’ve worked with many Business Owners like you who have done their research and are ready to get their business started. But inevitably, you get to one of these legal steps and get stuck trying to figure out the answer to what you think should be a simple question (but has taken up hours of your time in research). Your time is better spent working on the other parts of your business and leaving the legal work to a professional.

All those little questions that took up your entire afternoon can often be answered in an email or short phone call with a lawyer. Rather than spending your time on some mail-merging form website, we can work together to prepare your operating agreements, shareholder agreements, employee agreements and reviewing your lease agreement. Once it's all set up, we'll create a system to maintain your corporate documents so that you're ready for future growth and taking on investors.

If you’re ready to get started, I’ve got a simple 10-question survey that you can fill out to get the process started. Not sure that you’re ready to get started? We can also schedule a quick Legal Strategy Session to discuss where you are in the process of starting your business and we can plan out the next steps you need to take to get your business up and running.

Expanding a Business

One of the most exciting stages of your business is when you’ve outgrown your current situation. You’re probably running into one of these expansion situations,

- You and your current team can’t keep up with all of the customer orders.

- Your space is bursting at the seams and you need to expand your current office or maybe it’s time to even open another location.

- It is time to take on investors to support the expansion of your business.

If it’s time to expand your team, it’s a good time to review your employment contracts and team structure. As you expand, you may want to reward those early employees who stuck with you when times were tough at the beginning. Or perhaps you are now concerned that your employees may try to take some of your success secrets and open their own business. The expansion is a good opportunity to make sure your employment agreements have the provisions you need to protect your business.

When you expand your current space or look to open another location, the landlord is likely going to present you with a lease. Does the new lease have a personal guarantee for you to sign? Are you sure you want to sign that guarantee (and do you truly understand what you are signing? Now is a good time to speak with an attorney to review that lease and especially the personal guarantee if one is included.

If it’s time for your business to accept money from outside investors, those investors are going to want information about the business. Included in that information will be a look at the current shareholder agreements for the business to see what they are investing in and what kind of stake in the business they are getting for their money. While your discussions with investors may be informal, when it comes time to formalizing an investment, both you and the investors should have attorneys reviewing the paperwork to make sure everything is in order.

Whatever the reason for your expansion, as you take those next steps, it’s important to have an attorney by your side to help you through the process. If it’s time for your business to expand, let’s set up a Legal Strategy Session and discuss the best path forward for you and your business.

Negotiating Contracts

As your business gets started and grows, you’ll find that contracts seem to pop up in every area of your business. Some of the contracts will be long, 50+ page documents that have more “legalese” (dense legal terms) than you’ve ever seen in your life. You’ll spend hours poring over the terms and negotiating different points with the other party to the contract. Others are as simple as a one-page invoice for a product you ordered (that’s technically a contract). You just sign off, pay for the item and move on.

Your business will normally encounter contracts in two main ways. First, you’ll be the one to draft the contract. These contracts can be given to employees for the terms of their employment, to clients for the terms of paying for their services, and to others who perform work for your business.

While it may seem harmless, just grabbing a form off a website for your business to use can have drastic consequences. All of those terms and clauses have legal meanings and if you just copy a form without understanding it, you could be opening your business up to plenty of problems. Working with an attorney, we can make sure you’ve got the right contract for your business, and that the form protects you and your business in case of any problems with the contract.

The second way you normally encounter contracts is when it is given to you to review on behalf of your business. These tend to be documents like leases, service agreements with vendors, and other contracts where you are paying someone for services. Sometimes, these agreements are non-negotiable, the other party won’t make any changes. But often, it is better to meet with an attorney, review the terms of the contract, and then negotiate the terms that are concerning to you and your business. If the changes are very in-depth, you may end up drafting a whole new contract.

When you are negotiating your contracts, you will also need to decide how comfortable you are with the negotiating process. For those who enjoy it, negotiating contracts can be an interesting part of their business. But for many business owners, they would rather focus on their business and leave the negotiating to their attorneys and the other party’s attorneys. Whichever path you choose, reviewing the contract with an attorney is an important step before you sign the final contract.

If you’ve got contracts that need drafting, or you’ve been given contracts to review and sign, before you get in over your head, let’s set up a Legal Strategy Session to review the best way to proceed with getting them signed.

Collecting Client Balances

It is inevitable that at some point, someone is going to owe your business money. Sometimes your clients fall behind on their payments to your business. They stop answering your phone calls and emails. While they were once your “best friend” and you saw them daily, now you can’t find them.

You have a variety of options to collect the money that is owed to you, but one of the most effective is to work with a lawyer. This allows you to spend your time working in your business instead of chasing your clients for money. Many times, a letter from a lawyer will at least get your client to respond and agree to either pay the balance or create a payment plan to pay the money owed over time.

If those informal efforts don’t work, you can consider bringing a lawsuit against the client. Many business owners shy away from this option when the amount of money owed doesn’t seem “worth it” to bring a lawsuit. This creates frustration because it’s money your business is owed, but you feel like you don’t want to spend money on an attorney to collect it for you. It’s important to talk to a lawyer to discuss the economics of the possible lawsuit and if it makes sense to file it. Don’t forget to check your contracts, you may be entitled to collect your attorney fees if you’ve got that provision in your contract, which makes this decision significantly easier to make.

If you’ve already received a judgment from a court, we can work together to use the local laws to collect on that judgment. There may be legal mechanisms like wage garnishments (taking money from a paycheck) and bank levies (taking money from a bank account) available to you if you have a judgment.

I also work with out-of-state judgments against clients located in the states where I practice (Connecticut, Minnesota, New Jersey, New York). A judgment from your state may be eligible to be registered in another state and then it can be “enforced” as if it was a "local judgment." This is especially helpful when your clients have no other connections to the state where your business is located.

If your business is owed money and you would rather spend your time working in your business than chasing your clients, let’s schedule a Legal Strategy Session to discuss options to take the collection work off your plate.

Business Litigation

If you own a business that hasn’t yet been forced into a lawsuit, you’re way ahead of many other business owners. Unfortunately, business litigation (lawsuits involving businesses) is a fact of life for many Business Owners. It’s not a matter of if, it’s a matter of when. Even if you’ve done nothing wrong, you may one day be served with legal papers and find that your business is a party to a lawsuit.

If you have been served with legal papers, you must speak to an attorney. I don’t say that to frighten you into calling. Unlike a person who can “represent” themselves in Court, a company cannot represent itself. You can’t send the business owner or Joe from accounting who took a law class in college to appear at court appearances and represent your business. In order to participate in the lawsuit, you’ll need an attorney.

Large companies get sued all the time and they don’t worry about finding a lawyer. They have their own “in-house” lawyer who has a legal network of law firms that they work with and they send the case over to one of those law firms to handle for them. But having an in-house lawyer (often called a general counsel) isn’t in the budget for most business owners, there’s just not a need to pay a full-time lawyer to be on staff.

So when you receive those legal papers, it’s important that you not ignore them or toss them in the garbage. Once you’ve received them, there’s normally a time period in which you need to file and serve your response to those papers. Some time periods are longer than others, and you need to know how long you have to respond so you can plan out your response.

Business litigation doesn’t always have to be defensive. You may also find that your business is owed money or another business has infringed on your trademark or harmed your business in some way. It’s often best to try to work these issues out before filing a lawsuit, but sometimes it’s the only way to get your business what it deserves. You also need to consider the statute of limitations (how much time you have to file your claims) when deciding to file a lawsuit. Depending on the type of claim, the statute of limitations can be as short as 90 days or as much as 6 years or more for you to start your lawsuit.

No matter if you are filing the lawsuit or defending against it, for your business, each lawsuit is unique, so we’ll work together to determine the best way to address the claims (sometimes a settlement is the best way to protect your business). Many claims you will encounter are based on common legal issues, but I want to make sure that I’m the right person to handle your lawsuit. If we decide I’m not, then we’ll work together to find another professional who can step in and give your business the representation it needs and deserves.

If a lawsuit has been filed or needs to be filed, let’s set up a Legal Strategy Session to discuss the best options for your business. If the lawsuit has been filed, you can also fill out this short survey about the status of the lawsuit and any upcoming court dates.

Business Succession

Some Business Owners begin with the end in mind, but most don’t. If you’ve already thought about a plan for your business after you’ve retired or sold it to someone, you are ahead of most Business Owners. But if you haven’t, there’s no better time than now to start working on a plan.

A succession plan is like an estate plan for your business. You are putting together a plan for the business after you are gone. Included in that plan is how involved, if at all, you want to be in the business. Some Business Owners plan to leave the business and never look back. Others see all of the passion and hard work they put into the business over the years and want to stay involved on some level even after they’re gone.

Just as your business is unique and driven by you and your passion, so is your succession plan. We’ll work together to determine what’s best for you and the business and what that looks like for your business after you are gone.

The most important thing you need to know is that your succession plan needs to be clear and in writing. Many times, especially with a family business, you will assume that the business will just pass to your family and they will know what to do with it. But what if your children don’t want to run the business? Or your brother also wants to retire? Then what happens to the business you’ve spend your life’s work and energy on?

The clarity provided by a written succession plan is what will help you sleep at night. You won’t need to worry about which of your children will run the business. If they want to fight amongst themselves, the written plan will have the answers to resolve that fight without the need for lawyers and lawsuits. And you can use that written plan to craft your vision of your business for tomorrow and beyond.

If you don’t have a succession plan yet, let’s schedule a Legal Strategy Session to discuss the best options to protect your legacy and your vision for your business when you’re gone.

Corporate Dissolutions

A corporate dissolution is the legal terminology for when it’s time to shut down your business. They usually occur in three general categories,

- You choose to shut down your business

- Your business hasn’t paid its taxes

- A shareholder of the business sues the business

If you’ve made the decision to close your business, it’s unfortunately not as easy as just locking the door and turning off the lights. There are likely a variety of financial obligations that need to be wrapped up. Hopefully, you have an operating agreement for your business that has the process for a voluntary dissolution laid out so you have a recipe to follow. If not, you’ll need to look to your local laws regarding the process for a dissolution.

While you can normally see the voluntary dissolution coming, an involuntary dissolution can end up catching you by surprise and have large consequences. If you haven’t been filing your business tax returns, then you shouldn’t be too surprised that at some point, the government is going to notice. Usually, you’ll receive notices from the government about the unfiled returns and the fact that it could lead to an involuntary dissolution.

These notices are sent to the agent that is on file with the state (you set this up when you form the company). This demonstrates the importance of having the right agent for your company – you don’t want these notices sent to someone who just throws them in the trash. Hopefully, your agent will open the notices and make sure to notify you so that the unfiled tax issue never arises for your business.

The other common form of involuntary dissolution is when there is a lawsuit filed to dissolve your company. This usually happens when you have a disagreement between owners or shareholders of your company and there’s no way to resolve the issue. The dissolution by lawsuit is commonly referred to as a “business divorce” and it can be as messy and drawn out as a divorce between spouses.

Hopefully, your company has an operating agreement that spells out the mechanisms for dissolution when the owners disagree. If not, you have a “de facto” operating agreement, meaning the laws of your state govern and will determine how the dissolution is resolved. These lawsuits are not for the faint of heart and it’s important that before you take it lightly, you meet with an attorney to discuss your options. While in some cases the lawsuit will move quickly, I’ve also been involved in dissolutions that have taken years to resolve.

Whether your company’s dissolution is voluntary or involuntary, it’s a good idea to speak to an attorney, so let’s set up a Legal Strategy Session to discuss the options that make the most sense for your business.

Other Business Law Needs That Aren't Easily Categorized

Just like many of the laws from our government, there’s often one extra “catch-all” category of legal issues that don’t fit easily into a category. While the other topics on this page give you a general idea of the types of legal work that we can work on for your business, there are always other issues that don’t easily fit into a box.

Some of these will be “transactional” issues for your business. Usually, this will include drafting documents or submitting applications for your business. These aren’t always purely legal issues either – sometimes you may just want a second set of eyes to look over a document. As a business owner myself, I have faced many of the issues that your business faces and we can draw on my business experience in addition to my legal experience.

Other issues you may face will require court appearances or meetings with administrative boards regarding your business. When confronted with one of these issues, we’ll review the options for your business and determine if I’m the right fit to work with you or if there is another professional who is better suited to make sure your business gets the best possible outcome. One of the most interesting parts of my law practice is working with business owners on unique and novel legal issues, especially ones we can learn from together. It is also common for business owners to realize that they need to protect their personal legacy with an estate plan.

So, if there’s a legal issue affecting your business (or even a personal one that you’d like to run by a lawyer), let’s set up a Legal Strategy Session and determine a strategy for you to deal with it.