When a famous person passes away, the news often reports on their estate plan and what they have left behind. Many celebrities choose to use a trust and advanced planning techniques to keep their private affairs confidential. However, in some cases, there may be problems with the estate plan, leading to court filings.

Such is the case with Lisa Marie Presley, the granddaughter of Elvis Presley. According to recent news reports, in 2016, Lisa Marie created an amendment to her trust that removed her mother and business manager as successor trustees and replaced them with her two oldest children, Riley and Benjamin. However, in 2020, Benjamin died, leaving Riley as the only successor trustee.

Lisa Marie's twin daughters from a later marriage are not mentioned as trustees in the document, which is good as they are under the age of 18. However, there are concerns about the validity of the amendment, as it misspells Priscilla Presley's name, the signature does not appear to match Lisa Marie's, and there is no witness or notarization of the amendment.

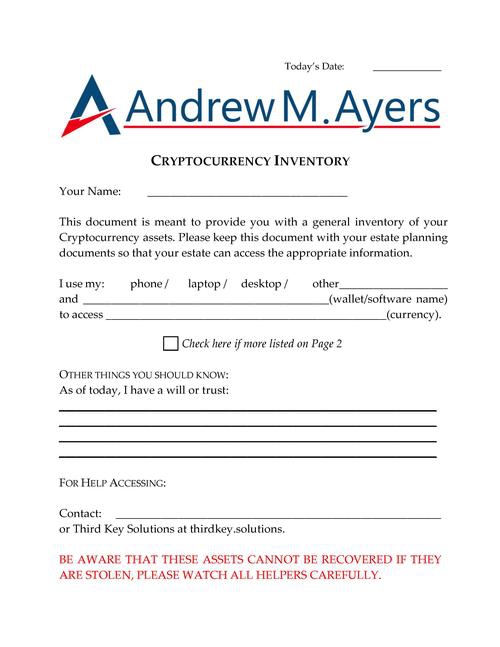

So far, no will has been filed, making the trust the operative document that controls what happens to Lisa Marie's fortune. This situation is likely just the beginning of the news regarding this estate.

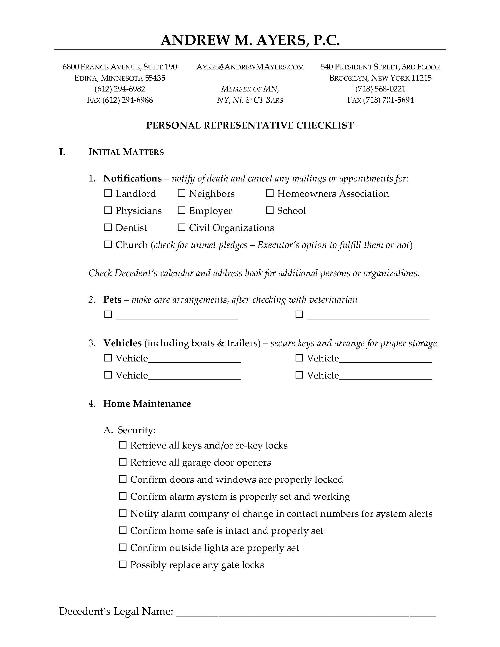

As a lawyer, there are a few things that Lisa Marie should have done before her passing to ensure that her estate was properly planned. First and foremost, she should have had a valid will. With twin daughters who are under the age of 18, it is important to have provisions for their care, including guardianship and a trustee to manage their finances.

If Lisa Marie did indeed amend her trust, it is important to make sure the amendment was done correctly. Each state has different requirements for signing a document, and a valid document usually needs at least one witness or a notary, and in most cases, both.

Additionally, it is important to review documents for spelling errors. Priscilla's concerns about the misspelling of her name raise a good point about the validity of the document.

In conclusion, estate planning is a complex process, and it is important to make sure that all documents are valid and up to date. If you are planning your estate or if you have concerns about a loved one's estate, it is always best to seek the advice of a qualified attorney.

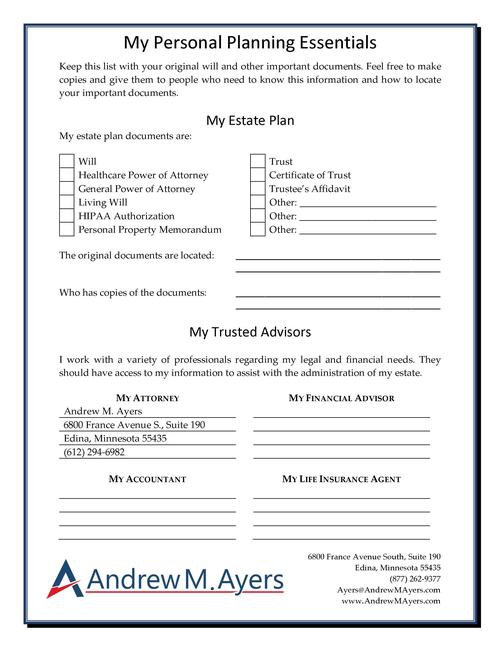

Do You Need an Estate Plan?

If you don't already have an estate plan, or if you have one that needs to be updated, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney to get your estate plan prepared.