What is a Pooled Special Needs Trust in Minnesota?

If you have a child receiving government benefits and has special needs, you want to make sure that you have the correct estate plan to protect those government benefits. One of the primary vehicles we're going to use for that is what's called a Special Needs Trust. In the world of Special Needs Trust planning, there are three main trusts that we like to use:

Now, in the case of a First Party Special Needs Trust, the assets in that trust belong to the person with special needs. The Third-Party and the Pooled trust allow you to use assets that come from third parties to fund a trust for someone with special needs. The key feature is that the trust make sure to keep the government benefits intact for the family member. We have to be sure what is being paid for what benefits are not being overlapped with the government so that we don't endanger their ability to receive government benefits.

How Does A Pooled Trust Works?

In the case of a pooled trust, it's a little bit different than the other two. In this case, it's usually a nonprofit or a charity that is holding the funds for the person with special needs. For example, you would leave a million dollars from your life insurance policy to a Pooled Trust. The non-profit or charity will be the one that's administering it for your family member with special needs, and this charity probably has a lot of different funds in it.

With a variety of sources of funds, the charity is able to take advantage of interest and a larger asset pool by having a lot of funds together. The charity is able to manage and help all those funds grow and then they have a way to administer and distribute the funds to the various family members and the various individuals who are members of pooled trusts.

A Pooled Trust doesn't just put your money into a big pot with everybody else without tracking. Each individual beneficiary (the person who has special needs) has their own account. The charity is tracking those funds and they are able to delineate who's getting their own funds, but they're using the advantage of having all the funds can combined together to be able to get a better return on interest and return on their investments.

How Are Funds Paid Out?

What happens with a Pooled Trust that's different than the other two types of trusts is that with a Pooled Trust, when the family member with special needs dies, whatever is left in the trust then goes to the charity and helps to fund their operations and whatever else they can use the money for. It's a way for you to incorporate special needs planning, with charitable giving into your estate plan. Now, by contrast, if you do a First Party Special Needs Trust, when the family member dies, the government is entitled to reimbursement from that trust. The reason a lot of people use the Third-Party Special Needs Trust when they can is that in those cases when the family member dies, you can have whatever's left in the trust can be distributed to other family members that he may have.

Next Steps

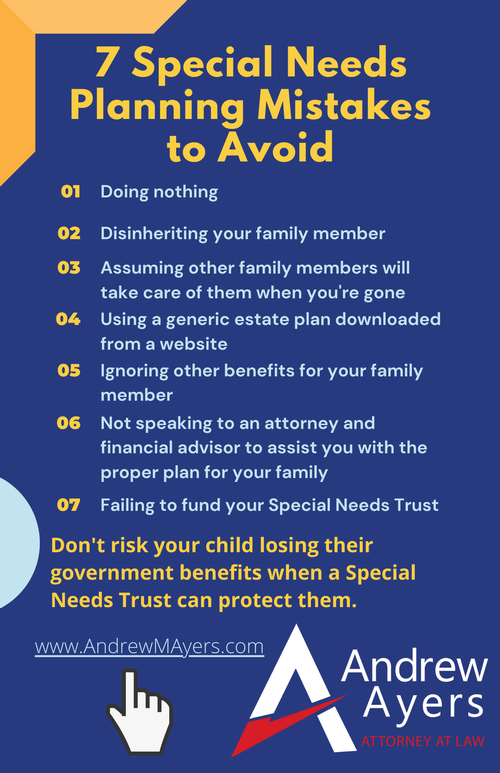

So we've gone quickly through these three different types of special needs trust today, and you're probably saying, "I'm not sure which one I need" or "I'm not sure what to do next?" So let's set up a legal strategy session, we'll hop on the phone for 15 or 20 minutes and go through your current situation, what your family needs and get some ideas for how we can move forward. This isn't one of those processes you want to leave to some generic website and hope that you get your estate planning right. There can be a variety of mistakes you can make and if you're worried about those mistakes, you can also find the 7 Special Needs Planning Mistakes to Avoid to get you started.