There's a common misconception that only the families of celebrities get caught up in battles over their estates after they are gone. There have been some high-profile battles recently, including Lisa Marie Presley's trust amendment, Naomi Judd cutting her daughters out of her estate, and Tupac's estate dealing with a dispute over an NFT. But at the other end of the spectrum, plenty of celebrities also have well-designed estate plans that avoid any notoriety or press after they are gone, other than a short mention in the news.

There's a common misconception that only the families of celebrities get caught up in battles over their estates after they are gone. There have been some high-profile battles recently, including Lisa Marie Presley's trust amendment, Naomi Judd cutting her daughters out of her estate, and Tupac's estate dealing with a dispute over an NFT. But at the other end of the spectrum, plenty of celebrities also have well-designed estate plans that avoid any notoriety or press after they are gone, other than a short mention in the news.

While the celebrities who leave behind an estate dispute make the news, it's actually a far more common problem for everyday people who never create an estate plan. Unfortunately, it happens more often than you might think. According to a study, a small percentage of wills and trusts written in America are formally contested when the person who made the will or trust dies. However, when it happens, the dispute is often ugly, and in most cases, the clash results in close relatives never speaking again for the rest of their lives.

It doesn't always have to be a large amount of money that's involved, it can also end up being a long, drawn-out battle over sentimental items of a family member's estate. There are no guarantees that you won't leave behind some hard feelings or family members who aren't happy with your estate plan, but there are some tips and strategies you can use to try to minimize battles over your estate.

Professional Advice

As a lawyer, you probably could have guessed that this would be my first tip, but it's an important one. Especially if you know that you may be leaving behind some kind of disagreements amongst your family members, it's important to make sure your documents are drafted in a clear manner that avoids multiple interpretations. You want to make sure you are minimizing the risk that an estate contest happens and another step in that process is to make sure that your documents are properly executed. One of the most common reasons for a contest is that someone believes a document isn't authentic or wasn't signed properly - just look at Lisa Marie Presley's estate!

Use a Contest Provision

It is common, even if you don't anticipate any battles over your estate, to include a contest provision in your estate plan documents as well. A typical provision would be something like,

If any person directly or indirectly attempts to contest or oppose the validity of my Will, (including any codicil to my Will), or commences, continues, or prosecutes any legal proceedings to set my Will aside, then that person will forfeit his or her share, cease to have any right or interest in my estate, and will, for purposes of my Will, be deemed to have predeceased me.

The validity of these clauses varies from state to state, but it's often included anyway to make sure your intentions are made clear.

Create Your Estate Plan While Your Capacity Is Good

This can be a challenge because by the time you've lost your capacity to make a document, you may not be aware of it. However, waiting to create or change your estate plan until your mind starts to slip is dangerous. Your estate could be successfully challenged if, at the time you created it, you failed to have the necessary capacity to understand what you were doing.

This is different from being physically unable to sign, which can be accommodated when it's time to formalize the documents. But if you lack the mental capacity to make a will or updates to your estate plan, this can be a common cause for a fight over your estate.

Don't Even Let It Appear That You Are Being Influenced By Someone

A common scenario that you may encounter:

- "My sister called the attorney to make the appointment for Dad. That sister drove Dad to his meeting. She told the lawyer what Dad wanted his will to say. The will left more to this sister than any other of Dad's children, and my sister was right there in the room when Dad signed everything."

This looks suspicious to all involved. Whether there was some undue influence or not, that set of circumstances doesn't sound too good. So, the suggestion here is not only don't let yourself be persuaded into leaving a bequest to someone when it doesn't feel right but also don't even let it appear that you are being adversely influenced.

Consider Using Trusts

While trusts can be contested almost as easily as it is for someone to question the validity of a will, it may make sense to consider creating one or more different kinds of trust in order to minimize the risk of dispute. Generally speaking, the terms of a trust that you create can remain private so that someone who is excluded from a trust may not be entitled to view the terms of a trust. While your will becomes public record at the courthouse after you pass away, instead of leaving assets outright to someone you suspect will dispute your estate, consider leaving those assets to a trust for the benefit of that person. This way, the potential challenger is not a participant in the estate settlement, only the trustee of that trust for the benefit of the potential challenger is a party to the estate settlement.

Communication Is Key

Proper communication with your future heirs will reveal why you did what you did. When a testy heir understands why you did what you did, they may be less likely to stir the pot. For example,

- Mom creates her estate plan and left 80% to child A and 20% to child B. After Mom dies, child B may contest the will. However, if Mom had communicated with child B and explained that child A needed more money because of a medical condition that she suffers from, then it may allow child B to take a step back and realize what Mom's true wishes were.

- Dad creates his estate plan and left an additional $50,000 to child C. But prior to his death, Dad explained to child A, child B, and child C, that child C has been taking care of Dad recently and has been using some of child C's own money to help Dad and this extra money is essentially a reimbursement for child C's assistance. It may leave child A and child B feeling a little guilty that they didn't step in to help Dad, but it will also allow them to understand the reasons for Dad's distribution.

If you create an estate plan, you aren't required for it to equally distribute your estate to your children. You can have unequal distributions or you can create some other system for distributing your estate. Without an estate plan, the law of your state will lay out how your estate will be distributed (and that may not be a distribution you'd be comfortable with).

Do You Need an Estate Plan?

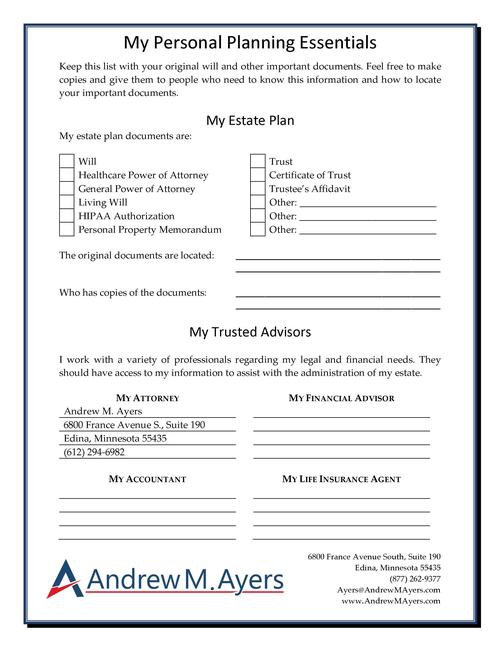

If you don't already have an estate plan, or if you have one that needs to be updated, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney to get your estate plan prepared.