What's the difference between a supplemental needs trust and a special needs trust?

We're going to talk about two terms you hear about a lot when it comes to special needs planning, and even though they may sound like they refer to different things, they're actually pretty much the same thing.

Historically, people have asked what's the difference between a Supplemental Needs Trust and a Special Needs Trust? When we first started doing special needs planning, the idea was that you're creating a trust to supplement the government benefits that your family member with special needs is receiving. Because that was the goal of the trust and we didn't have any laws that specifically addressed it, the common term that we started using was a "Supplemental Needs Trust," because that's what the trust was doing, supplementing their needs.

In 1993, the federal government passed a law that created a bit of a change to the way we can do this planning. Prior to the law, the trust had to be funded with assets that did not belong to your family member with special needs. But the 1993 law allowed for that trust to be funded with the special needs person's own assets, what we call a First Party Special Needs Trust, and that became known as the Special Needs Trust. People still colloquially refer to the other trusts as the Supplemental Needs Trust.

Since 1993, the words have still been used, but the reality is, we've really come down to three types of trusts at this point. And they're all doing the same purpose. They're all here to supplement the government benefits of your family member so that they aren't lost. But the difference is, how they do it and what are the assets that make up the trust? A Special Needs Trust is what we're calling these. It can be called a Supplemental Needs Trust, if you hear it from certain people, but in the end, it's going to be a Special Needs Trust:

- First Party Special Needs Trust ~ a trust that is set up with the actual assets of your family member. So for example, if they're receiving a settlement from a lawsuit or they've been divorced, or they have other money coming to them through inheritance. If that asset is used for the trust to fund the trust, that's called a first-party special needs trust.

- Third-Party Special Needs Trust ~ a trust that is funded with somebody else's assets. This is a very common situation where parents are leaving money for a child with special needs. They want to make sure the government benefits stay intact. So they fund the trust sometimes the life insurance policy or retirement benefits, but it's their assets. Not the child's assets that are being used to fund the trust.

- Pooled Trust ~ the assets are also a third-party's asset, where the assets are pooled together and a charity or a nonprofit organization manages the funds. You can think of this as compound interest. The charity is monitoring a bunch of different assets. So let's say we have 10 different children with special needs. All of their trust assets are pooled together so that you can earn more money and they can be invested. And then what happens is at the end of the trust, when it terminates (when the child with special needs dies), if there's anything left in the trust, it is that given to the charity to help them towards the mission and help them run their charity. So this is a way to actually merge a special needs trust with your charitable giving.

So the evolution of this term over time has gone from a Supplemental Needs Trust to a Special Needs Trust to now where we really are working with these three categories (First Party, Third Party, and the Pooled Trust).

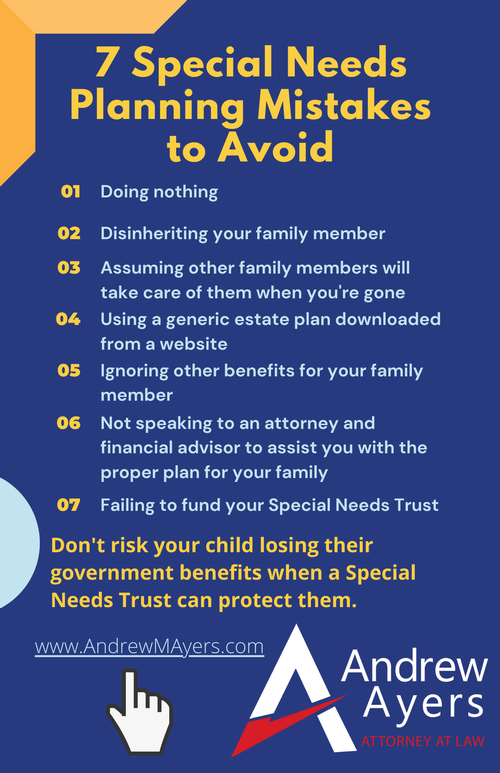

Now this isn't the type of legal work that you want to try to do on your own. You may have a friend, you may be in a Facebook group with others who have done this kind of work in the past, but you want to make sure you're working with a professional to get the right trust for you and your family. If you have a child with special needs who is receiving government benefits and you don't have an estate plan that has some kind of a trust to protect them, it's very important that you talk to professionals. Talk to your financial advisor, your accountant, that care manager who works with your children and your child and talk to an attorney.

If you don't have anybody, let's set up a Legal Strategy Session and we can have a quick phone call to go over your current situation and make sure we get the right trust documents for you. Whether you call it a Supplemental Needs Trust or Special Needs Trust, it's just important that you have it in place for your family members.