What is a first party special needs trust?

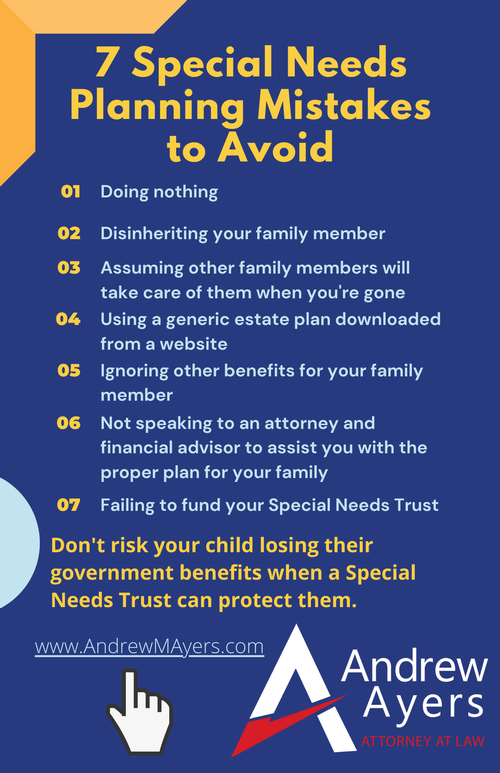

A special needs trust is a special type of trust that we create when you have a child or a family member is receiving government benefits. We want to make sure that if something happens to you, any inheritance that comes from you doesn't endanger those benefits. In the world of special needs trust, there's three main types:

The third-party trust is a trust that's funded with money from third parties to benefit your family member and the pooled trust is one that is managed by a non-profit or a charitable organization for the benefit of a variety of individuals who need a special needs trust.

First-Party Special Needs Trusts

When you are creating a first-party special needs trust, there's a few requirements that you need to know about:

- It has to be set up by a parent or grandparent or guardian or a court.

- It must be irrevocable ~ Irrevocable is one of those legal words that a lot of people hear and they aren't sure exactly what it means. When we're dealing with trusts, it means your trust cannot be changed. If you've put money into the trust, you can't then go back in and take it back out. Irrevocable trusts are often used for later in life planning to get assets out of your name, to also preserve benefits that you may have at that later stage in life.

- The assets in the trust must actually belong to the beneficiary ~ With a third-party trust or a pooled trust, you can use other assets to fund those trusts but in this case, the asset must be belonging to your child or your family member with special needs.

- The person has to be under 65 ~ There actually is an age requirement on these types of special needs trusts.

- When the trust is terminated (when your family member who has special needs dies), the government is entitled to reimbursement from money that's left in the trust. It's this reason that a lot of people are not sure that they want to use this type of trust.

You may say "I don't want the government to be reimbursed, I'd rather use a pooled trust so a charitable organization gets reimbursed or a third-party trust so that the money can stay in our family," but there will be times when the first-party special needs trust may be the right choice for you.

When Should I Use a First-Party Special Needs Trust?

Although many people object to the government being reimbursed, there are situations when a First-Party Special Needs Trust is the right choice:

- The family member is receiving an inheritance, the money is theirs. Usually, it wasn't properly planned for and put into another type of trust. It's going to come to them under the terms of a will. That is first-party special needs trust is likely the best option for them.

- If they've been in a lawsuit. Let's say there's a personal injury lawsuit or they've gone through a divorce and they're receiving a sum of money from that lawsuit. That is their money under the terms of the judgment under the terms of the settlement of whatever they're getting. And if it's a judgment, it's going to come directly to them. If it's a settlement, hopefully, you've worked with the right professionals to find a way to maybe get it into a third-party special needs trust, or maybe get it into a pooled trust, but assuming it's straight money coming to them from a lawsuit, and that's an asset belonging to your family member with special needs, and first-party special needs trust may be the way to go.

Now as you can tell with these three different types of trust bouncing around, not everyone is in the right place for each one. It really depends on your family situation and the situation of your family member with special needs. So if this is all confusing, and you're not sure what you need to do, let's set up a Legal Strategy Session to go over your current situation and maybe go through some options and some good ideas to help you take those next steps.