What does a special needs trustee do?

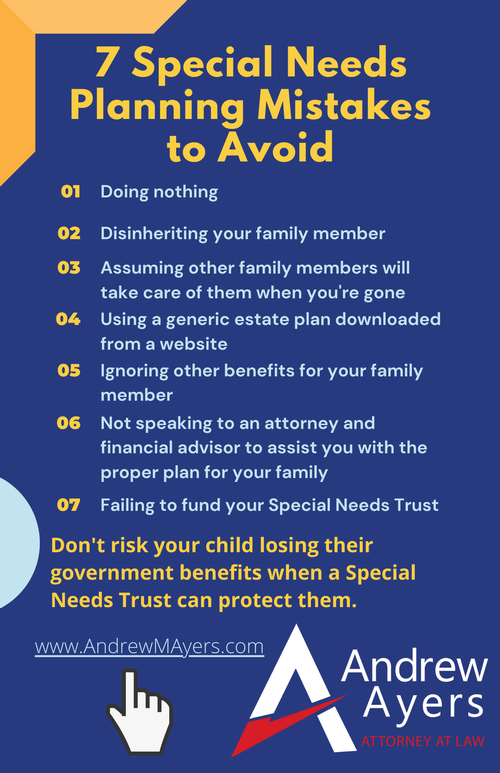

Before we get into the roles of the trustee, we need to understand the three different types of trusts that we're dealing with in the special needs area:

Each of these trusts is different but they all have the same goal, which is to make sure that if you have a child or you have a family member that has government benefits due to their special needs, they do not lose access to the government benefits by virtue of inheritance.

General Trustee Responsibilities

Generally, any kind of trust will have a trustee that has certain roles. So for example, one of the responsibilities that a trustee has is going to be communicating with the beneficiary of the trust. The beneficiary is the person who is receiving the benefits of the trust. Now, if you're not creating a special needs trust, you may actually be the grantor meaning the person who's granting assets to the trust, as well as the trustee who's going to be administering that trust, but the trustee's role has to be to communicate with those beneficiaries.

They also need to distribute money to the beneficiaries. Now in the special needs context, this will be very important to make sure that we don't do any improper distributions. The third role they have to is that they have to take care of is the investment and management of the trust assets. You don't want to just take all your money and leave it in cash, just leave it in a bank account not earning any interest. That's not a good use of your money. And frankly, you should be working with a financial advisor anyway, when you're setting up a trust. Hopefully that financial adviser can be working with your trustee to make sure that the trust assets are managed and invested to get the most out of your legacy.

The trustee also is going to be in charge of accounting and bookkeeping for the trust. So you may not have thought of this at the time, but when you create the trust, there is a taxable piece to this and once your trust is funded and starts distributing money, there's going to be taxable implications. So you need somebody to be able to account for the funds and manage the funds and do the bookkeeping that comes with it. And that leads to the final role, taxes for the trust. So depending upon where your trust is set up, most states will have some kind of a tax impact on the trust depending upon how much is in the trust and what kind of distributions are made. But regardless, your trustee has to be aware of the taxes and be ready to step in to handle them.

So when you're choosing a trustee, these are the basic things that you're gonna have to consider.

Special Needs Trustees

Now, when we're looking at a special needs trust, we're gonna have some extra things that a normal trustee won't necessarily have to deal with, like

- The needs of the beneficiary ~ if you have somebody who has special needs and is receiving government benefits, we want to see what needs they have on a month-to-month and daily basis. What kind of services do they need?

- We want to make sure that they're being provided for and that they also work with your beneficiary to make sure that we're keeping them eligible for government benefits. And that's going to be the primary role of any special needs trustee, as that's kind of your overall goal with your special needs trust. We want to make sure we protect those government benefits.

- When you have somebody who's receiving government benefits, there's often an agency they're dealing with, whether it's social security, SSDI, Medicare, Medicaid, whatever they're dealing with, we want to make sure that that agency is getting the right reports. So the trustee may have to create reports on a quarterly or annual basis for the agency who they interact with, who is providing the benefits for your family member.

- The trustee of a special needs trust has to work with your other loved ones, and the other support workers like care managers, to make sure that your beneficiary is being cared for. We want to make sure your family member has the best quality of life possible, beyond just the basic government benefits provided. We want to make sure that they're happy, and that we can provide as many services as we can while protecting the government benefits. To do that the trustee has to be in constant contact with the family members with the care manager to make sure we're keeping an eye on your beneficiary and that they're getting the best health we can give to them.

Who Should Be The Trustee?

Now the biggest question that I get from my clients is, who should I choose for this role? If you've gone through these 9 different areas that we've just talked about, you may think this seems like a little bit more than I thought this could be, a lot more than I bargained for. And oftentimes you can be right in the special needs area. If you're doing a basic trust that's just for some grandkids, and there's not a lot of complexity to it, then choosing family members is often all you need to do.

However, when it comes to the special needs trust and it comes to the government benefits and the accounting and the taxes and the bookkeeping and everything else they're going to have to deal with, a lot of times it'll make more sense to work with a professional trustee. A company that does this for a living. This is what they do. The trustee focuses solely on people with special needs. We want to make sure that they understand all of the issues and they can provide for your beneficiary as best they can. They're not going to do this for free. There will be a cost associated with it. However, compared to having your cousin try to sort out all the government paperwork, it may be worth it to have a little cost associated to make sure those government benefits are protected.

So as we've gone through all the different things that your trustee is going to have to do, let's talk to your accountant, your financial adviser, work with an attorney, get an entire ecosystem set up for your family member, make sure those government benefits are protected. What are the best next steps for you? This is not something that you want to just hand off to some cousin who really doesn't know your family. Remember, the role of a trustee for your special needs trust is incredibly important and you don't want to just leave it to chance.