Estate planning is not a topic that people generally like to think about. It can be unpleasant to contemplate our own mortality and the inevitable distribution of our assets after we're gone. However, proper estate planning is an essential aspect of financial planning that should not be overlooked. Unfortunately, many people make common estate planning mistakes that can be detrimental to their loved ones in the event of their untimely demise.

Celebrities are not exempt from making estate planning mistakes. In fact, many celebrity estates end up in the news when something goes wrong. Some examples include the ongoing saga of Prince's estate, Naomi Judd changing her will, and a fight over a trust amendment in the Lisa Marie Presley estate.

One celebrity estate that has recently made headlines is that of Stephen "Twitch" Boss, the DJ for The Ellen DeGeneres Show, who died in December 2022. Twitch left behind a wife and three children, and his wife claims that he died without a will. This means that the distribution of his assets will be decided by the state of California, which could lead to a lengthy legal battle.

Twitch's estate planning mistake is a reminder that estate planning is not just for the rich and famous. Everyone can benefit from having an estate plan in place to ensure that their assets are distributed according to their wishes. Here are four lessons we can learn from Twitch's estate planning mistake:

Lesson 1: Have a Will

The most important lesson we can learn from Twitch's estate planning mistake is the need for a will. A will is a legal document that outlines how your assets will be distributed after you pass away. If you die without a will, it's called dying "intestate," and the state will decide how your assets will be distributed.

In Twitch's case, he left behind three children under the age of 18. A will would have provided for guardianship of these children and appointed a trustee to manage funds for them while they were underage. Without a will, his family members will be left to decide who should take care of the children. This could lead to a lengthy court battle that would only add to the stress and emotional turmoil of losing a loved one.

Lesson 2: Use Beneficiary Designations

Another lesson we can learn from Twitch's estate planning mistake is the importance of beneficiary designations. Beneficiary designations are a way to ensure that your assets go directly to the person or people you choose, without going through probate court.

Twitch had an investment account, and if he had designated a beneficiary, the account could have gone directly to that person without going through the local probate court. Unfortunately, many people make the mistake of listing their estate as the beneficiary, which means that the money has to go through probate court first. This can delay the distribution of assets and add unnecessary legal fees.

Lesson 3: Use Transfer-on-Death Designations

Twitch owned several companies or had an ownership interest in various companies. To keep these assets out of probate court and out of the public eye, he could have created transfer-on-death designations for his ownership interest.

A transfer-on-death designation is a legal document that allows you to transfer ownership of an asset to a designated beneficiary upon your death. This ensures that your assets are distributed according to your wishes without going through probate court. Transfer-on-death designations can be used for a wide range of assets, including real estate, stocks, and vehicles.

Lesson 4: Update Your Estate Plan Regularly

It's unclear when the last time Stephen Twitch Boss updated his estate plan was, but if he had any changes in his life such as the birth of a child, a change in his financial situation, or a change in his relationships, it's important to update your estate plan to reflect these changes. Failing to do so can lead to unintended consequences and disputes after you pass away.

While Stephen Twitch Boss was a celebrity, his estate planning mistakes and the lessons we can learn from them are applicable to anyone. By having a will, ensuring that your investment accounts have beneficiary designations, creating transfer-on-death designations for business interests, and updating your estate plan regularly, you can help ensure that your assets are distributed according to your wishes and avoid lengthy court battles and disputes among your loved ones.

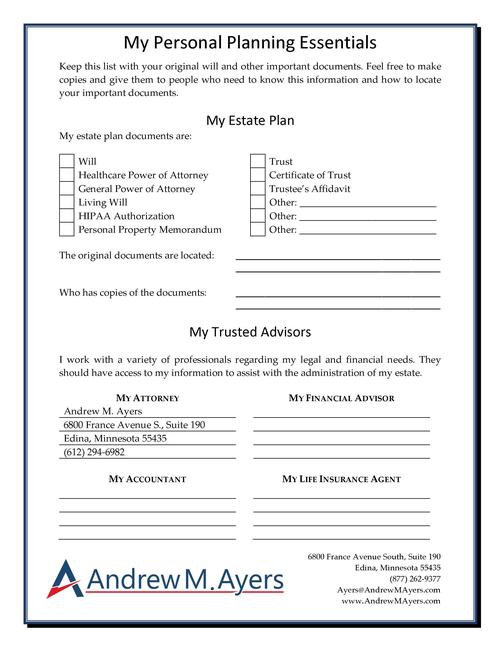

As an estate planning attorney, I know that planning for the inevitable can be a difficult and uncomfortable process, but it's an important one. By working with an experienced attorney, you can create an estate plan that protects your loved ones and your assets, and gives you peace of mind knowing that your wishes will be carried out after you pass away. Don't wait until it's too late, start your estate planning today.

Do You Need an Estate Plan?

If you don't already have an estate plan, or if you have one that needs to be updated, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney to get your estate plan prepared.