If you've never created an estate plan before, you may think that it needs to be an intense and complicated process with an attorney who charges you by the hour and monthly bills that seem to skyrocket each time they arrive. Fortunately, you're probably mistaken on most of those fronts, and if any of those are reasons that are keeping you from getting started, you can easily move past them.

If you've never created an estate plan before, you may think that it needs to be an intense and complicated process with an attorney who charges you by the hour and monthly bills that seem to skyrocket each time they arrive. Fortunately, you're probably mistaken on most of those fronts, and if any of those are reasons that are keeping you from getting started, you can easily move past them.

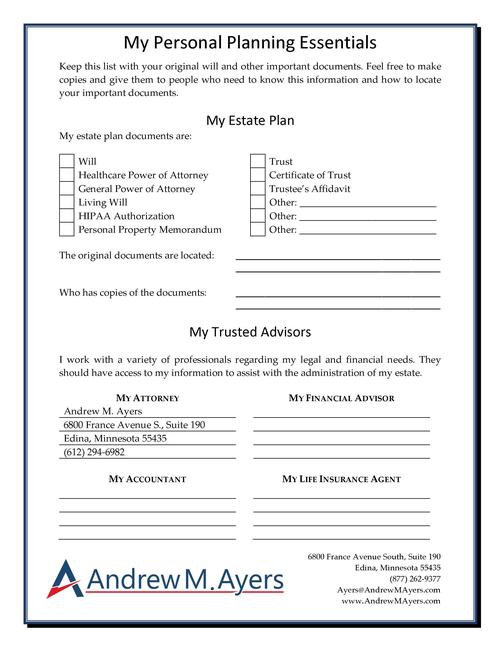

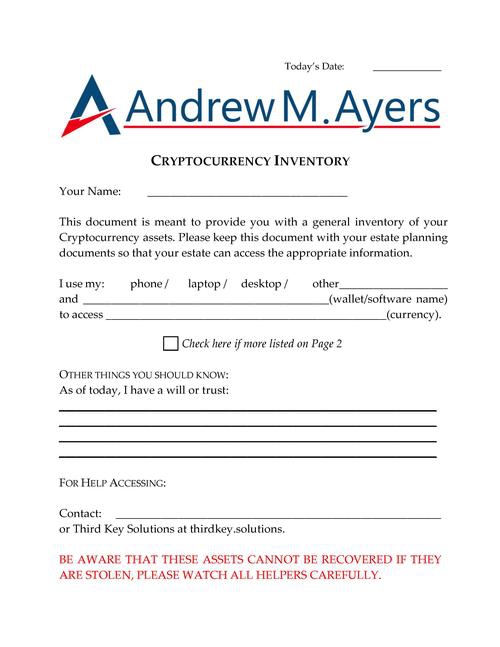

In the past, many of those general fears may have been based on a bit of reality, but today, you can craft a personalized estate plan with an attorney who charges you a flat fee and can get it done without dragging the process out for months. The danger comes when you try to shortcut the process totally and just download some estate plan forms from a website that is merely mail-merging your information into their forms. If you aren't careful, you can check the wrong box and end up with a complicated Missouri will with other state-specific documents, when you actually live in Minnesota and need documents that are crafted for you and your family.

One of the most common sources of new clients coming to my office is that they paid some money and downloaded forms from an online site, only to realize that they really don't understand the documents and aren't sure what to do next. Please don't end up in that situation, it's easily avoidable.

To help you get started with the process, let's look at 5 tips you can use when creating your first estate plan (and these tips can also be useful even if this isn't your first time creating one...)

5 Tips for Your First Estate Plan

Hopefully, you're reading on because you understand the importance of having a will, no matter where you are in the process. Your will can be a primary way to avoid battles over your estate after you're gone.

-

A bequest to your spouse: If you're married, you'll need to decide how you want to leave your portion of the assets that the two of you have to your spouse. Some people leave everything to their spouse, which could lead to your surviving spouse leaving your estate to anyone they want. Alternatively, you could make your portion of the estate available for your spouse's needs but dictate where it goes after they pass away.

-

A bequest to your kids: If you have children, you'll need to decide whether you want to leave your estate outright to them or in a trust. If you leave your estate outright, your kids will inherit the entire estate and can do with it what they wish. If you leave the estate in a trust, you'll appoint a trustee to manage the assets and your kids will receive their inheritance over time. One of the common misconceptions I run into is that you must leave equal shares of your estate to your children, but you can leave unequal inheritances to your children if you choose to do so. Without a will, the law will default to equality amongst your family.

-

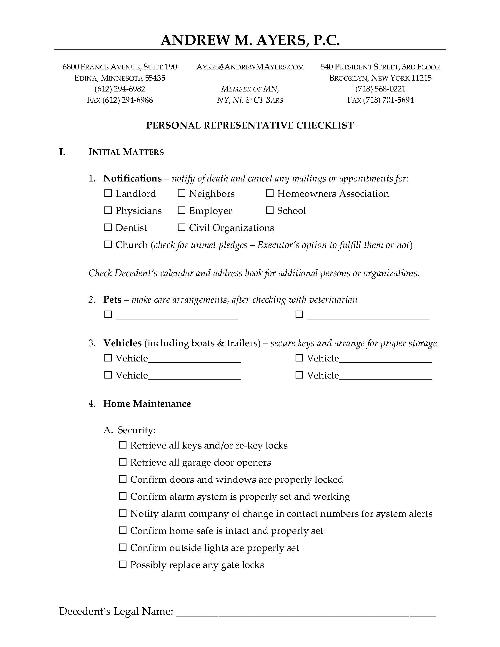

Your Personal Representative/Executor: When making your will, you'll get to name one or more personal representatives/executors (they use different terms in different states) who will be in charge of settling your estate when you pass away. It's also a good idea to name alternate executors, and married people often name their spouse as the primary executor.

-

Will versus living trust: Some people make their first will and later regret not creating a living trust instead. A will simply leaves all of your assets in your name when you pass away, while a living trust allows you to transfer ownership of your assets to the trust while you're still alive. It's important that you understand the differences between a will and a trust.

-

Working with an Attorney: You're reading an estate planning attorney's blog, so you surely could have guessed that this would be one of the tips that I have for you. You don't need to fumble through this process on some mail-merging website. Work with an attorney who can help guide you through the process and make sure you're getting the right documents for you and your family's legacy.

Do You Need an Estate Plan?

If you don't already have an estate plan, or if you have one that needs to be updated, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney to get your estate plan prepared.