A will is a straightforward document that states who will receive your assets when you pass away. If you have children under the age of 18, it's important that your will also includes a provision naming a guardian for your children and a backup guardian. Additionally, you may want to set up a trustee and a trust in your will to manage money for your children until they reach the age of 18. The will also appoints an executor or personal representative whose role is to take the will to the local probate court and show it to them. This person is responsible for distributing your assets according to the instructions in the will. It's important to have at least one or two backups in case something happens to your first choice for executor or personal representative.

A trust is a more complex and in-depth legal entity that works in conjunction with your will. The most common type of trust is a revocable living trust. However, there are other types of trusts that may be appropriate for your situation. For example, an irrevocable trust is a trust that cannot be changed, and it's an advanced estate planning tactic that not everyone needs. A special needs trust is a trust that is set up for a family member who has special needs and is receiving government benefits. A special needs trust allows them to receive money and inherit money without losing their government benefits.

A trust is a way to hold assets on behalf of someone else. You will designate beneficiaries, who are the people who can receive the benefits of those assets. You will also designate trustees, who are the people who will manage the assets. When assets are moved into a trust, they are converted into assets that are owned by the trust. For example, if you move a house into a trust, you will have to draft a new deed that states that the house is owned by the trust.

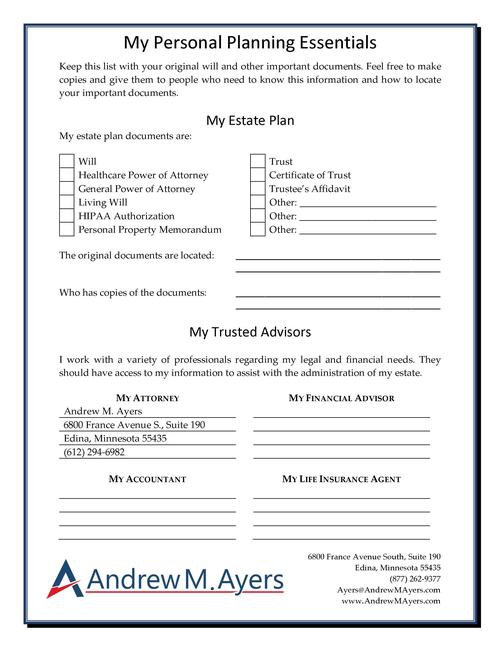

The main reason people use trusts is because it allows them to keep certain assets out of probate court and to protect assets from creditors. It's important to consult with an attorney to determine whether a will or a trust, or both, is appropriate for your estate plan. An attorney can help you navigate the complex world of estate planning and ensure that your assets are distributed according to your wishes.

Do You Need an Estate Plan?

If you don't already have an estate plan, or if you have one that needs to be updated, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney to get your estate plan prepared.