When it comes to handling an inheritance from a family member, it can be a confusing and overwhelming experience. You may be uncertain about what to do with the funds and how to protect them in the event of a divorce. In this video, we will be discussing the steps you can take to ensure that your inheritance is considered separate property and not joint marital property in the event of a divorce.

Separate Property Laws and Inheritance

In most states, an inheritance from a family member is considered separate property. However, it is important to look into the local state laws to understand how the mechanics of handling the funds will be dealt with. If you have a prenuptial agreement, it will state that what is in your name remains in your name as separate property. If you receive an inheritance during the marriage, you can put that inheritance into a separate account or into another account solely in your name, to ensure that it is kept separate and not treated as marital property in the event of a divorce. If you don't have a prenuptial agreement, you will need to look at the situation in the same way and determine if you will be able to trace that inheritance.

Commingling of Assets

One of the biggest issues that can arise when dealing with an inheritance is the commingling of assets. Commingling occurs when separate property is combined with marital property, making it difficult to identify what was separate property and what was joint marital property. For example, if you and your spouse have a joint bank account and you receive an inheritance of $50,000, instead of putting the funds into a separate account, you put it into the joint account. If you spend money from that account, it becomes challenging to trace the funds back to the inheritance. This can be detrimental in the event of a divorce, as the court will need to determine which funds are separate property and which funds are joint marital property.

To prevent the commingling of assets, it is essential to keep the inheritance separate from the marital property. This can be done by putting the inheritance into a separate account solely in your name or into an account designated for the inheritance. It is also essential to avoid using the funds for joint expenses or depositing other money into the account. By keeping the funds separate, it is easier to trace the funds and prove that they are separate property in the event of a divorce.

It is crucial to handle an inheritance from a family member with care. By understanding the local state laws and taking steps to prevent the commingling of assets, you can ensure that your inheritance is considered separate property and not joint marital property in the event of a divorce. Remember to keep the funds separate and avoid using them for joint expenses to make it easier to trace the funds back to the inheritance.

Do You Need a Prenuptial Agreement?

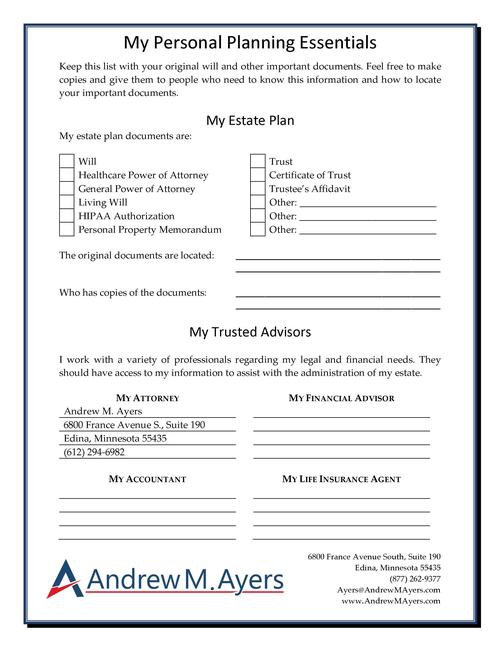

If you're getting married, you and your soon-to-be spouse may want to consider a prenuptial agreement and you should schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to get a prenuptial agreement prepared.