Ever get caught up pondering about the 'after-you'? What happens to your hard-earned wealth when you're no longer around to steer it?

Sounds dramatic, doesn't it? But it's a real concern for many, especially when the next generation might lack the financial knowledge to handle their inheritance responsibly.

You've worked hard to accumulate your wealth. You've pulled all-nighters, made sacrifices, and triumphed over obstacles. And naturally, you want to ensure that your wealth isn't squandered away; you want it to continue providing for your loved ones, maybe even for generations to come.

But how do you exert control from the grave?

It may sound like science fiction, but there's actually a tested and proven strategy. The secret isn't in a crystal ball or a time machine. It's called smart estate planning.

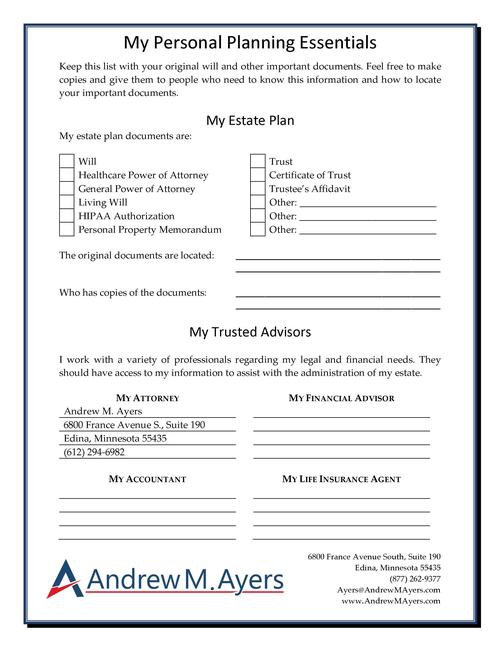

Smart estate planning provides you with tools to dictate how your assets should be managed after your departure. You can set up conditions for inheritance disbursement – tying it to age, achievement of certain milestones, or even linking it to responsible spending habits.

Imagine being able to guide your family's financial future, even when you're not physically present. It's not just possible; it's achievable.

The secret is to start planning now. Tackling the awkward, uncomfortable conversations today can ensure a smooth, hassle-free future for your loved ones tomorrow. And you can finally put your worries to rest.