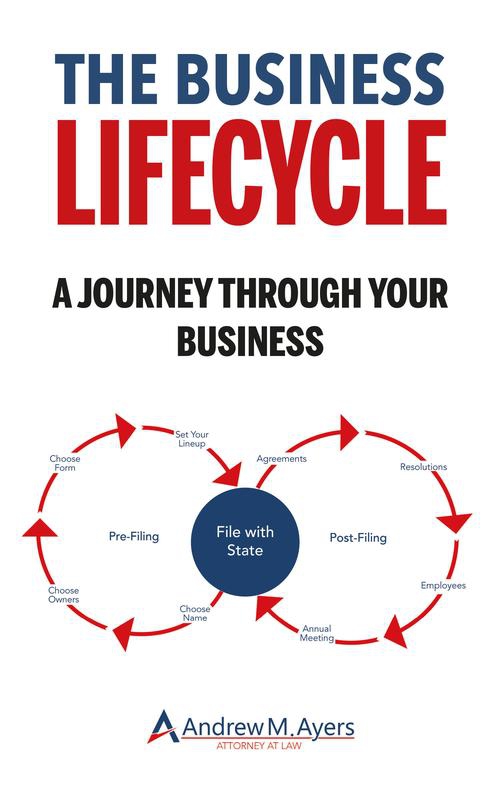

At the beginning of your business journey, you're faced with a lot of decisions. When you get around to decisions about the legal structure of your business, it is common to consider creating an LLC (Limited Liability Company). These corporate structures have become a great entity for those looking to protect their personal assets as well as seeking to use some tax strategies to save money on their taxes as well.

At the beginning of your business journey, you're faced with a lot of decisions. When you get around to decisions about the legal structure of your business, it is common to consider creating an LLC (Limited Liability Company). These corporate structures have become a great entity for those looking to protect their personal assets as well as seeking to use some tax strategies to save money on their taxes as well.

As their popularity has grown, many websites and companies have popped up that offer easy creation of your LLC. To peer behind the curtain, however, you'll find that often these are nothing more than mail-merging sites that are marking up the costs to file with your state. The irony is that you can save your money and file your documents directly with your state and save your money.

The clear allure of these sites is that they will do the filing for you and that may be enough to justify the added cost of using a service to file your initial LLC documents. However, the metaphor I commonly use with my clients when they ask about these sites is a skydiving one. Using these sites is like the company taking you up in a plane, telling you what you need to do to jump out of the plane, and then handing you the parachute. It all seems reasonable until you realize that they never showed you how to use the parachute and more importantly, never strapped you into the parachute.

In the case of an LLC, that parachute is your LLC Operating Agreement. It provides you protection as you jump out of the plane and start your business journey. But just being given a template agreement without signing it and tailoring it to your LLC? That's like jumping out of a plane without strapping the parachute to your body, so let's look at five challenges you may encounter if your LLC doesn't have an operating agreement.

5 Reasons You Should Have an Operating Agreement for your LLC

If you've created your LLC by filing your documents with your state, you've taken care of the first steps in the process, the ones that require you to make a filing with the state. However, since you don't have to file your operating agreement with the state, many LLC's just get on with their business once the state filings are done and forget to come back to complete their operating agreements. When you are working with a mail-merging website for filings, they won't keep you accountable to remember to get your operating agreement drafted and signed. They'll provide you with a basic template and leave you to be on your merry way.

Without that signed operating agreement in place, there are five common challenges you may encounter:

- Default State Laws Apply: Without an operating agreement, your LLC is automatically subjected to the default state laws where the LLC was formed. These laws may not suit the specific needs of your business or its members, potentially leading to unfavorable governance and operational structures.

- Management Uncertainties: LLCs thrive on clear management structures. Without an operating agreement, roles and responsibilities can become blurred, leading to inefficiencies or disputes among members. This lack of clarity can impede decision-making and operations.

- Financial Disorganization: Operating agreements define profit sharing, capital contributions, and financial responsibilities among members. The absence of such agreements leaves these critical areas to be governed by generic state laws, which might not reflect your intentions or the LLC's operational reality, risking financial chaos.

- Legal Vulnerabilities: An operating agreement reinforces the limited liability status of an LLC, protecting members' personal assets from business liabilities. Operating without this document could expose members to increased legal risks, potentially jeopardizing their personal assets.

- Impact on Single-Member LLCs: Even single-member LLCs are advised to have an operating agreement. While the immediate operational impact may seem negligible, having this document can provide clarity for financial institutions, legal entities, and in the event of the owner's incapacity or death.

While not always legally required, operating agreements play a critical role in the smooth operation, legal protection, and financial clarity of LLCs. Their absence can lead to governance by default state laws, management, and financial disorganization, and increased legal vulnerabilities. LLCS should draft and maintain an operating agreement tailored to their specific business needs.

Do I Need a Business Attorney?

Now is a good time to get up to date on your LLC documents, so if you'd like to discuss them further, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you and your business.