Last week, I had some meetings with clients who were looking to revise their estate plans. It’s pretty common that they did their wills years ago and things have changed. Those kids that were toddlers last time around are now grown and have toddlers of their own. One of the clients had also acquired some other property and had heard about a power of attorney as a way to allow one of his kids to manage the property if he became ill.

Last week, I had some meetings with clients who were looking to revise their estate plans. It’s pretty common that they did their wills years ago and things have changed. Those kids that were toddlers last time around are now grown and have toddlers of their own. One of the clients had also acquired some other property and had heard about a power of attorney as a way to allow one of his kids to manage the property if he became ill.

My friend Tony and I put together a series of presentations for some of his co-workers who were interested in financial planning and estate planning. We put the talks together into a free report that our clients have found to be easy to read and helpful. So, I made sure to give the client a copy of the report so he could get some more information before our next meeting.

For those who are interested, here’s the short chapter we put together on powers of attorney:

Power of Attorney

Tony

Power of attorney. I think we should touch on that. Power of attorney is basically giving somebody the authority to speak on your behalf. It happens where people become incapacitated. It happens when you’re not able to speak for yourself. Therefore, not having a power of attorney really can be a significant struggle should something happen to one of you. As an example, if you can’t speak on your own behalf, the stock market drops. I can’t take instructions from anyone to buy or sell anything.

Nothing. I can’t do a thing. The thing can go to zero before we would have any ability to do anything. It’s a legal process. If you can’t speak on your own behalf and you haven’t designated anybody else, nobody can do anything. Nobody can do anything about your house. Nobody could, if you needed stuff taken care of. The good thing is let’s say you’re incapacitated and you live. What happens during that period of time of all of your affairs that may need to be… Something has to be done. Nobody can do it. Having a power of attorney, I think is exceptionally important. Making sure that somebody has that-

Andrew

For non-joint assets. If you have a joint bank account, they can do what they’re going to do. But if it’s an asset that’s solely in your name, your spouse can’t just automatically make decisions.

Tony

Here’s the other thing. If you give power of attorney authority to us that says, “My spouse can speak on my behalf to buy and sell investments in my IRA account, that’s titled only in my name.” They can also request the distribution check. But that distribution check goes to made out to the individual account owner. They can’t transfer it into their name.

There’s a lot of opportunity but also limitations and you can control some of that stuff too, particularly through a power of attorney that you would do as part of an estate plan because you can give much wider, broader and restricted limitations, if that’s the right word, I guess in that context, through a power of attorney through an estate planner. You can say, “Literally my husband only has responsibility in the decision making around the dog. Everything else, he’s not competent to handle anything else.” Or vice versa. Everything but the dog. Right? You could be very specific. Any questions on this?

Next Steps

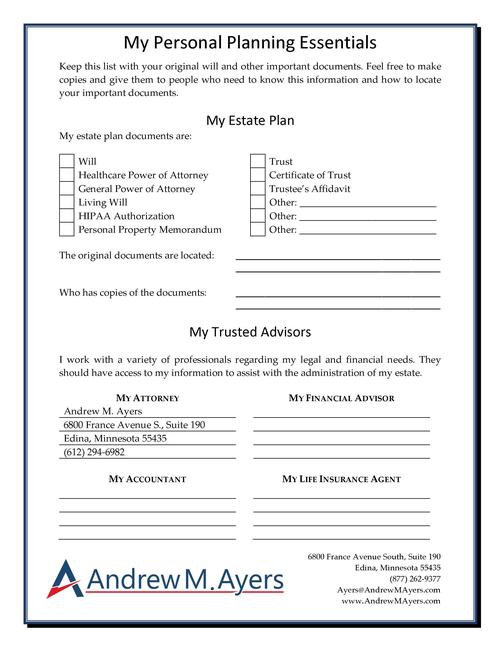

If you need to update your power of attorney (or if you don't have one yet), let's set up a Legal Strategy Session to discuss the next steps for you and your family.