A common question at new client meetings is What is Probate? If you've read articles or blogs or listened to podcasts, chances are they've spent a good amount of time discussing "probate" and the follow-up question is always

A common question at new client meetings is What is Probate? If you've read articles or blogs or listened to podcasts, chances are they've spent a good amount of time discussing "probate" and the follow-up question is always

How Do I Avoid Probate?

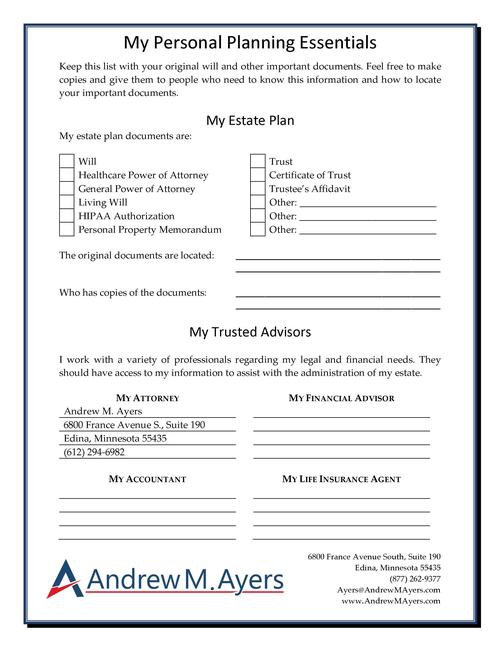

There are a variety of planning mechanisms that can be used to avoid probate. Some examples include

- Wills

- Revocable Living Trusts

- Beneficiary Designations

- Joint Accounts & Property

- Assignments/Transfers of Interests

- Transfer on Death Deeds (aka Beneficiary Deeds)

- Pay on Death/Transfer on Death Designations

If you go to an online website, they will try to fit you into a one-size-fits-all category. They will sell you on one (or all) of the above options. But each person’s situation, like a snowflake, is unique. Rather than just mail merging your information to all of the above-documents, you should speak to an attorney. This is also a good discussion to have with your financial planner too.

Should I Avoid Probate?

Before being overly concerned about avoiding probate, you should determine whether you need to avoid it or not. Probate can be a good thing where you have an estate that should be monitored. If there are creditors, then it gives them a defined cut-off date for their claims. If they fail to make a claim, they are time-barred from doing it later.

One of the main disadvantages to the process is the time and expense that can be involved. This is the primary pain point that people seek to avoid when creating an estate plan. There are also privacy concerns in states where the person’s will, estate, and beneficiaries become a matter of public record. For most people, the disadvantages outweigh the advantages and they want to avoid probate if possible.

Why You Might Not Need to Avoid Minnesota Probate Court

When you follow most of the information on the internet, when it comes to estate planning, the common wisdom is that you need to create a trust and do whatever you can to avoid probate. However, if you live in Minnesota, this may not be the approach you need to follow. Minnesota provides for a special type of probate proceeding called "Informal Probate" that is specifically created to make the process easier on individuals who are appointed as a personal representative. There are certain types of estates that qualify for this type of probate, and it is also something you can specifically provide for in your will with a provision that opts into informal probate proceedings if possible.

Next Steps

If you don’t have a will yet, or if you have one that you may need to update to avoid probate, let's set up a Legal Strategy Session and we can review the best options for you.