Are there any assets that you shouldn't put in your will?

It seems that recently there's been some kind of an update to some of that online drafting software that prepares estate plans. What I've been seeing with clients who come to me who have drafted their wills online is that there are some assets in there that really shouldn't be in there.

Four Assets That Shouldn't Be In Your Will

There are four different types of assets that we want to make sure are not included in your will.

- The first one is going to be your retirement accounts. Now you may think that it's a simple part, that you want to make sure you leave your retirement accounts to your wife to your husband, to your children. And it seems if you're using these online sites that maybe that's a reasonable way to plan for your assets. However, the real way you want to handle these assets is to use a beneficiary designation. By using that beneficiary designation, whatever's in your retirement account can be rolled directly over to your spouse or to your children. In the case of your spouse and your children, this is a tax-preferred way to distribute that asset to them. It doesn't have to pass on through your will and there's no involvement of the probate court. However, if you don't do it correctly, and you list the beneficiary as your estate then what has to happen is the IRA, your 401k, has to get distributed to your estate. Then your executor or personal representative then has to take the next step of distributing it to your family members. And in doing so you've lost most of the tax benefits that you would have had with a straight beneficiary designation.

- The second asset we want to make sure that's not in your will is any insurance policies - this is a big dangerous one you want to watch out for. It's just like retirement accounts. When you set up that insurance policy, you're creating a beneficiary designation, who's going to receive the proceeds from that insurance account, that insurance policy when you're gone. If you haven't correctly designated your spouse or your children, when you're gone, that money goes directly to them. But what happens if you don't? What if you put your estate down again, and let's say you have a $10 million life insurance policy, or even just a $5 million life insurance policy in most states that $5 million life insurance policy will push you right up to or above estate tax problems. So a beneficiary designation would allow your spouse to get that $5 million without having the taxes of the estate tax on it. But if you put it in the will first it has to go to the executor, the personal representative, and then get transferred over. You're looking now at an estate tax problem. You can be giving up to 40% of that money to the government because you didn't put down the correct beneficiary.

- The third type of asset to keep out of your will is any assets that you own in a trust. Many of my clients will work with me and a financial advisor to create a trust. It's a very smart way to plan for your assets. It keeps these assets in the trust out of probate and keeps things private for you. However, if you've got a will that says you want to leave my home to my wife, but you've already transferred that home to the trust, the provision in your will doesn't do anything. The trust is going to determine where that asset goes. And it may not seem like a big deal, but if you made your will a while ago, and your trust says something different, you've now got a conflict between these two documents, and the will is going to be the one that gets overwritten by the trust, which says where those assets are going to go.

- The fourth asset we're going to keep out of your will is property that you own in an LLC. Many of my clients like to use rental properties as a way to generate extra income and own that property in their own name, which causes a lot of problems and additional taxes that you may run into. Instead, we'll set up an LLC to own the property to manage it to invest. If you've created an LLC, you can't then say that 123 Spruce Street, which you is your property but is owned by the LLC, will go to your daughter, and then 125 Spruce Street, a townhome next door that you also own, goes to your son, the will is not going to control at that point. The LLC actually owns those properties so your will is not going to be able to do anything with that asset. And frankly, when you're working with those LLC and setting them up we want to make sure we already have a succession plan. That LLC interests can be what's transferred to somebody else, if something happens to you. And by using the LLC, we're keeping that property out of probate court, and we're keeping privacy as well. So if you don't want people to know what the property is that you actually own, that LLC allows you to shield so we've looked at the four assets that shouldn't be in your will today, your retirement accounts, your insurance policies, assets that are already in a trust and assets that are already in an LLC.

Next Steps

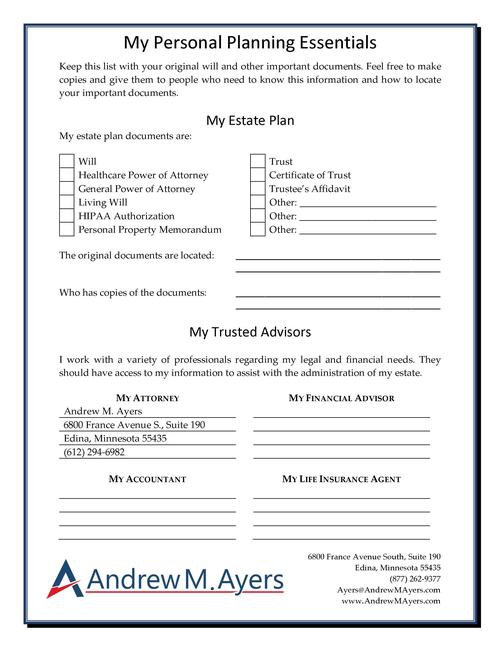

So if you've used an online drafting software, or maybe you've even worked with an attorney in the past and you have these assets in your will let's make sure we get that will cleaned up, make sure your estate plan is properly drafted and these assets are really going where you want them to go. If you're ready to get started, let's set up a Legal Strategy Session, a 15-20 minute phone call where we can discuss your current situation and some options for you and your family to move forward protecting your legacy.